Market Trends

Key Emerging Trends in the Immunoassay in R D Market

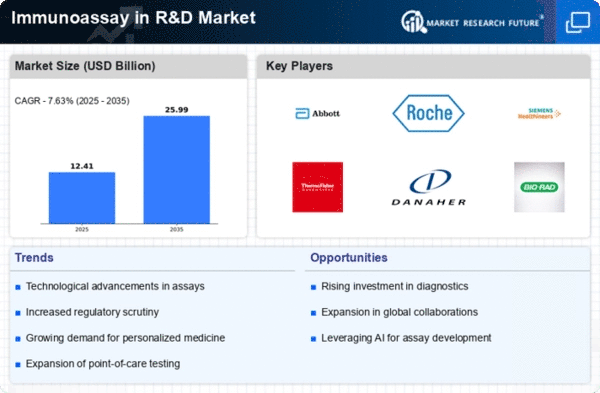

The global immunoassays R&D market is growing due to increased demand and technological advancements. However, a shortage of skilled professionals could slow down growth. Opportunities are arising in untapped emerging economies. The demand for immunoassays has surged in sectors like pharmaceuticals, contract research, and academia, particularly in drug and vaccine development. The pharmaceutical and biotechnology industries, driven by the need for small molecule drugs, biologics, and regenerative medicines, are major contributors to this demand. Ongoing trends, such as the approval of new therapeutics and investments in cell and gene therapy, are also boosting the market. Additionally, the rising demand for precision medicine, driven by the prevalence of chronic diseases like cancer, is a significant factor. The growth in biologics, quick approvals of new treatments, and the prevalence of cancer are driving the adoption of immunoassays in R&D.

Advancements in immunoassay instruments, leading to faster research and development, better quality control, and improved manufacturing processes, are propelling market growth. The launch of automated platforms, like the Quanterix Simoa HD-X automated analyzer, is enhancing sensitivity, robustness, and throughput in bioanalytical studies. The rise of multiplexing technology, which speeds up immunoassay tests in pharmaceutical and biopharmaceutical industries, is in high demand. Multiplex immunoassays generate more data points per sample, reduce costs, and minimize errors and sample handling. Organizations are launching multiplex technologies, such as the CaptSure Multiplex, to meet consumer demand and support pharmaceutical companies in developing rapid assays. These factors are driving the overall growth of the market.

In summary, the global immunoassays R&D market is experiencing growth fueled by increased demand across various sectors and technological advancements. While the shortage of skilled professionals poses a challenge, untapped emerging economies present promising opportunities. The pharmaceutical and biotechnology industries are major contributors to the growing demand for immunoassays, driven by the need for diverse drugs and therapies. Ongoing trends, such as the approval of new therapeutics and investments in innovative medical approaches like cell and gene therapy, contribute to market expansion. The rising prevalence of chronic diseases, especially cancer, is boosting the demand for precision medicine, further supporting the adoption of immunoassays in research and development. Additionally, advancements in immunoassay instruments and the implementation of automated platforms and multiplexing technology are enhancing efficiency and throughput in bioanalytical studies, contributing to the overall market growth.

Leave a Comment