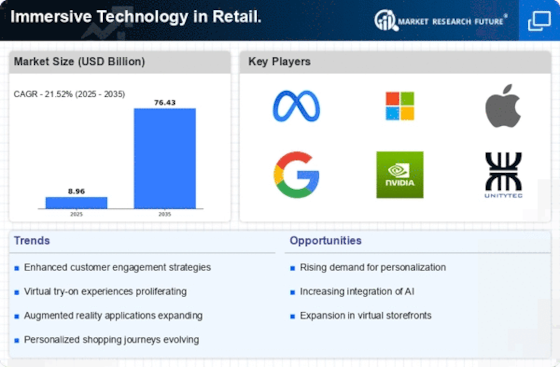

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Immersive Technology in Retail Industry Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Immersive Technology in Retail Industry industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Immersive Technology in Retail Industry industry to benefit clients and increase the market sector. In recent years, the Immersive Technology in Retail Industry industry has offered some of the most significant advantages to medicine.

Major players in the Immersive Technology in Retail Industry Market, including Acer Inc., Atheer, Inc., AVEVA Group PLC, Barco NV, Blippar Ltd., Carl Zeiss AG, CM Labs Simulations Inc., EON Reality, Inc., FAAC Incorporated, Google, LLC, HCL Technologies Limited, Honeywell International, Inc., HTC Corporation, Immersive Media Company, Immersive Technologies Pty Limited, Lockheed Martin Corporation, Magic Leap, Inc., NCTech Limited, Oculus (Facebook Technologies, LLC.), Samsung Group, Sony Corporation, Unity Software Inc., Varjo Technologies Oy, VI-grade GmbH, Zeality Inc. and others, are attempting to increase market demand by investing in research and development operations.

Lockheed Martin Corp. (Lockheed Martin) is a company that produces aerospace and security goods. The business is engaged in the study, creation, manufacture, and integration of high-tech systems, goods, and services. Additionally, it provides services in management, technical, engineering, science, logistics, system integration, and cybersecurity. Military and rotary-wing aircraft, airlifters, ground vehicles, missiles and guided weapons, radar systems, sensors, unmanned systems, and naval systems are among the company's product offerings. For military aircraft, ground vehicles, missile defense systems, satellites, and space transportation systems, Lockheed Martin offers support and upgrade services.

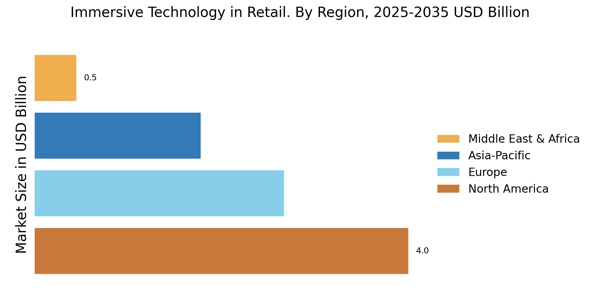

Both business clients and the US government are served by it. The Americas, Africa, Europe, Asia-Pacific, and the Middle East are all regions in which the organization conducts business. The US city of Bethesda, Maryland, is home to Lockheed Martin's headquarters.

Magic Leap Inc. (Magic Leap) is a technology company that develops computer software and user interfaces. The company creates light field display technologies for virtual animations and virtual reality experiences. It is possible to buy the Magic Leap One Creator Edition headset. You may experience both the real and virtual worlds thanks to a cutting-edge computing platform called Magic Leap. For web developers, it makes it possible to create and play games as well as browse spatially and extract content. It collaborates with academic institutions, tech firms, and businesses that make motion pictures and television shows.

The retail, sports, healthcare, and entertainment sectors in the United States. Magic Leap is headquartered in Plantation, Florida, a US city.