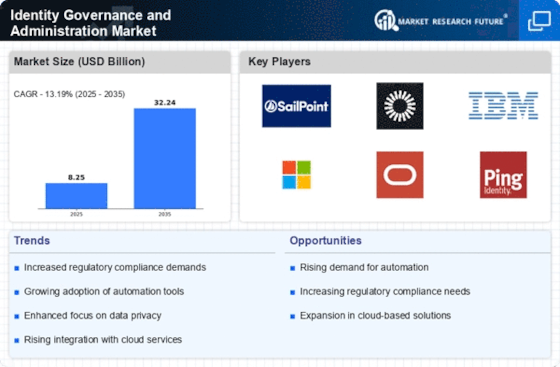

The Identity Governance and Administration Market is currently experiencing a transformative phase, driven by the increasing need for organizations to manage user identities and access rights effectively. As businesses expand and adopt digital solutions, the complexity of identity management escalates. This market appears to be evolving in response to regulatory pressures and the growing emphasis on data security. Organizations are recognizing the necessity of implementing robust identity governance frameworks to mitigate risks associated with unauthorized access and data breaches. Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning is likely enhancing the capabilities of identity governance solutions, enabling more efficient monitoring and management of user activities.

In addition, the rise of remote work and cloud-based applications is reshaping the landscape of identity governance. Companies are increasingly seeking solutions that provide seamless access control while ensuring compliance with various regulations. This trend suggests a shift towards more adaptive and scalable identity governance systems that can cater to diverse organizational needs. As the market continues to mature, it may witness further innovations aimed at improving user experience and operational efficiency, ultimately leading to a more secure digital environment for organizations across various sectors.

The identity governance and administration market is witnessing significant growth as organizations increasingly adopt structured identity governance frameworks to manage access rights, ensure regulatory compliance, and mitigate cybersecurity risks. The growing adoption of identity governance frameworks reflects the increasing need to control access privileges, enforce compliance policies, and prevent unauthorized activities. Advanced identity access governance capabilities enable organizations to monitor user behavior, enforce segregation of duties, and reduce identity-related risks. The deployment of automated identity governance solutions improves visibility, accountability, and compliance across enterprise environments.

Increased Regulatory Compliance

Organizations are prioritizing compliance with evolving regulations, which is driving demand for comprehensive identity governance solutions. These frameworks help ensure that user access aligns with legal requirements, thereby reducing the risk of penalties.

Modern identity management software enables organizations to automate provisioning, monitor access rights, and ensure continuous compliance with regulatory frameworks. The adoption of integrated identity management solutions is increasing as enterprises seek scalable platforms to manage complex identity lifecycles. Advanced identity management tools support real-time monitoring, policy enforcement, and risk mitigation across digital environments. Organizations are increasingly deploying a centralized identity management platform to streamline identity workflows and enhance governance capabilities.

Integration of Advanced Technologies

The incorporation of artificial intelligence and machine learning into identity governance solutions is enhancing their effectiveness. These technologies facilitate real-time monitoring and predictive analytics, allowing organizations to proactively manage identity-related risks.

Shift Towards Cloud-Based Solutions

As businesses increasingly adopt cloud services, there is a notable trend towards cloud-based identity governance systems. These solutions offer flexibility and scalability, enabling organizations to manage identities across diverse environments more efficiently.

The integration of identity access management software with identity governance platforms enables organizations to strengthen authentication controls and improve policy enforcement. The deployment of identity governance and administration platforms in the BFSI sector ensures secure access control, regulatory compliance, and risk mitigation. Healthcare organizations increasingly rely on identity governance administration systems to protect patient data and enforce access policies across digital health platforms.