Growing Demand in Healthcare

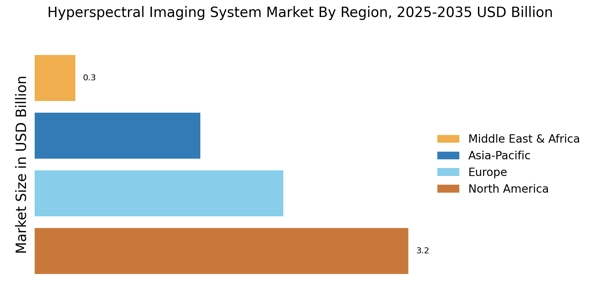

The healthcare sector is increasingly recognizing the potential of hyperspectral imaging systems for various applications, including disease diagnosis and surgical guidance. The Hyperspectral Imaging System Market is benefiting from advancements in medical imaging technologies that allow for non-invasive and real-time analysis of tissues. This capability is particularly valuable in oncology, where early detection of tumors can significantly improve patient outcomes. The market for medical applications is projected to grow at a CAGR of around 12% over the next five years, reflecting the rising demand for innovative diagnostic tools. As healthcare providers seek to enhance patient care through advanced imaging techniques, the adoption of hyperspectral imaging systems is likely to gain momentum, further contributing to the growth of the Hyperspectral Imaging System Market.

Focus on Environmental Monitoring

Environmental monitoring is a critical area where hyperspectral imaging systems are making a substantial impact. The Hyperspectral Imaging System Market is increasingly utilized for assessing air and water quality, tracking pollution levels, and monitoring biodiversity. Governments and organizations are investing in these technologies to comply with environmental regulations and to promote sustainability. The market for environmental applications is expected to grow significantly, with estimates suggesting a potential increase of over 20% in the next few years. This growth is driven by the need for accurate and timely data to inform policy decisions and conservation efforts. As environmental concerns continue to rise, the role of hyperspectral imaging in monitoring and managing natural resources is likely to expand, further solidifying its importance in the Hyperspectral Imaging System Market.

Increased Adoption in Agriculture

The agricultural sector is increasingly adopting hyperspectral imaging systems to enhance crop management and yield prediction. The Hyperspectral Imaging System Market is witnessing a surge in demand as farmers utilize these systems for precision agriculture. By analyzing plant health, soil conditions, and nutrient levels, hyperspectral imaging provides actionable insights that can lead to improved crop productivity. Reports suggest that the agricultural segment accounts for nearly 30% of the total market share, reflecting its significance. As sustainability becomes a priority, the ability to monitor and manage resources efficiently through hyperspectral imaging is likely to drive further adoption. This trend indicates a promising future for the Hyperspectral Imaging System Market, as it aligns with the growing need for sustainable agricultural practices.

Rising Investment in Research and Development

Investment in research and development is a key driver for the growth of the Hyperspectral Imaging System Market. As industries recognize the potential applications of hyperspectral imaging, funding for R&D initiatives is increasing. This investment is crucial for developing new technologies and improving existing systems, which can lead to enhanced performance and broader applications. Various sectors, including defense, agriculture, and healthcare, are allocating resources to explore innovative uses of hyperspectral imaging. The market is expected to see a rise in collaborative efforts between academic institutions and private companies, fostering innovation. This trend suggests that the Hyperspectral Imaging System Market will continue to evolve, driven by a commitment to advancing imaging technologies and expanding their applicability across diverse fields.

Technological Advancements in Hyperspectral Imaging

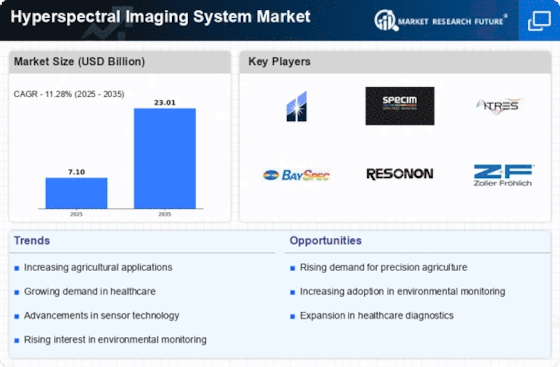

The Hyperspectral Imaging System Market is experiencing rapid technological advancements that enhance imaging capabilities. Innovations in sensor technology, data processing algorithms, and miniaturization of equipment are driving this growth. For instance, the integration of artificial intelligence and machine learning into hyperspectral imaging systems allows for more accurate data analysis and interpretation. This is particularly relevant in sectors such as healthcare and environmental monitoring, where precise data is crucial. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, indicating a robust demand for advanced imaging solutions. As these technologies evolve, they are likely to open new applications and improve existing ones, further propelling the Hyperspectral Imaging System Market.