Expansion in Emerging Markets

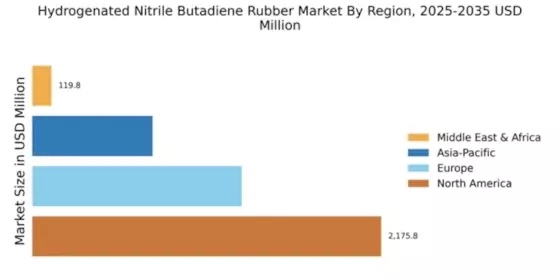

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is witnessing expansion in emerging markets, where industrialization and urbanization are accelerating. Countries in Asia-Pacific and Latin America are increasingly adopting hydrogenated nitrile butadiene rubber due to its superior properties and versatility across multiple applications. The growing automotive and oil and gas sectors in these regions are particularly driving demand. As these markets develop, the industry is poised for substantial growth, contributing to the overall market value projected to reach 6.96 USD Billion by 2035.

Growth in Oil and Gas Applications

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is significantly influenced by the growth in oil and gas applications. This material is favored for its excellent resistance to oil, making it ideal for seals and gaskets used in drilling and extraction processes. As global energy demands rise, the oil and gas sector is expected to expand, thereby increasing the consumption of hydrogenated nitrile butadiene rubber. The industry's projected growth to 6.96 USD Billion by 2035 indicates a robust market potential, driven by the need for durable and reliable materials in challenging environments.

Increasing Focus on Sustainability

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is increasingly shaped by a focus on sustainability and eco-friendly materials. Manufacturers are exploring bio-based alternatives and recycling methods to reduce environmental impact. This shift is driven by regulatory pressures and consumer preferences for sustainable products. As industries strive to meet sustainability goals, the demand for hydrogenated nitrile butadiene rubber, which can be produced with lower environmental footprints, is expected to rise. This trend may further propel the market's growth, aligning with global efforts to promote sustainable practices across various sectors.

Rising Demand from Automotive Sector

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry experiences a notable surge in demand from the automotive sector, primarily due to the increasing need for high-performance materials that can withstand extreme temperatures and harsh environments. Hydrogenated nitrile butadiene rubber is utilized in various automotive components, including seals, gaskets, and hoses, which require superior resistance to oils and fuels. As the automotive industry continues to evolve, with a projected market value of 2.62 USD Billion in 2024, the adoption of hydrogenated nitrile butadiene rubber is likely to expand significantly, contributing to the overall growth of the industry.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of hydrogenated nitrile butadiene rubber are enhancing the efficiency and quality of production. Innovations such as improved polymerization techniques and better compounding methods are enabling manufacturers to produce higher-grade materials that meet stringent industry standards. This evolution not only boosts the performance characteristics of hydrogenated nitrile butadiene rubber but also reduces production costs, making it more accessible to various industries. As a result, the Global Hydrogenated Nitrile Butadiene Rubber Market Industry is likely to witness a compound annual growth rate of 9.3% from 2025 to 2035, reflecting the positive impact of these advancements.