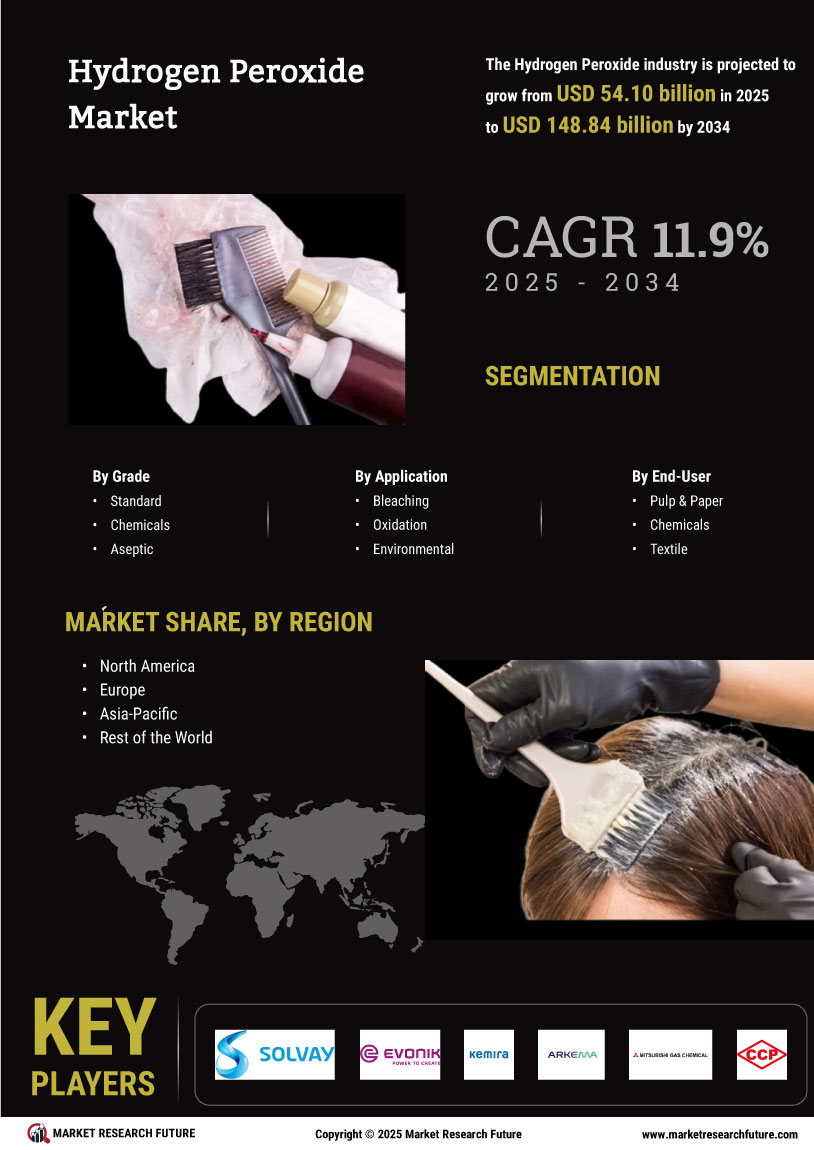

Market Growth Projections

The Global Hydrogen Peroxide Market Industry is on a robust growth trajectory, with projections indicating a market value of 48.3 USD Billion in 2024 and an anticipated increase to 166.6 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 11.9% from 2025 to 2035. Various factors, including rising demand in healthcare, environmental applications, and technological advancements, are driving this expansion. The market's diverse applications across multiple industries underscore its potential for sustained growth in the coming years, positioning hydrogen peroxide as a critical component in various industrial processes.

Increased Use in Textile Industry

The textile industry is increasingly adopting hydrogen peroxide for its bleaching and cleaning properties, significantly influencing the Global Hydrogen Peroxide Market Industry. As manufacturers strive for higher quality and sustainability in textile production, hydrogen peroxide emerges as a preferred alternative to chlorine-based bleaches. This shift is driven by consumer demand for eco-friendly products and compliance with environmental regulations. The textile sector's growth, particularly in emerging markets, is likely to enhance the demand for hydrogen peroxide, further contributing to the market's expansion and the anticipated growth trajectory towards 166.6 USD Billion by 2035.

Rising Demand in Healthcare Sector

The Global Hydrogen Peroxide Market Industry experiences a notable surge in demand from the healthcare sector, primarily driven by its applications as a disinfectant and antiseptic. Hospitals and healthcare facilities increasingly utilize hydrogen peroxide for sterilization and infection control, particularly in surgical settings. The global emphasis on hygiene and safety standards further propels this trend. As of 2024, the market is projected to reach 48.3 USD Billion, with the healthcare segment contributing significantly to this growth. This trend is expected to continue, as the industry adapts to evolving health regulations and the need for effective sanitization methods.

Growth in Environmental Applications

Environmental concerns are increasingly influencing the Global Hydrogen Peroxide Market Industry, particularly in wastewater treatment and pollution control. Hydrogen peroxide serves as an eco-friendly oxidizing agent, effectively breaking down organic pollutants and disinfecting water supplies. Governments worldwide are implementing stricter regulations regarding water quality, thereby enhancing the demand for hydrogen peroxide in environmental applications. This trend is likely to bolster market growth, as industries seek sustainable solutions. The anticipated growth in this sector aligns with the overall market projection of 166.6 USD Billion by 2035, reflecting a growing recognition of hydrogen peroxide's environmental benefits.

Expansion in the Pulp and Paper Industry

The Global Hydrogen Peroxide Market Industry is significantly impacted by the expansion of the pulp and paper sector, where hydrogen peroxide is utilized as a bleaching agent. This application not only enhances the brightness of paper products but also aligns with the industry's shift towards environmentally friendly practices. The demand for high-quality, sustainable paper products is on the rise, prompting manufacturers to adopt hydrogen peroxide in their processes. As the pulp and paper industry continues to grow, the hydrogen peroxide market is expected to benefit, contributing to the projected CAGR of 11.9% from 2025 to 2035.

Technological Advancements in Production

Technological advancements in the production of hydrogen peroxide are poised to reshape the Global Hydrogen Peroxide Market Industry. Innovations in production methods, such as the anthraquinone process, enhance efficiency and reduce costs, making hydrogen peroxide more accessible across various industries. These advancements not only improve yield but also minimize environmental impact, aligning with global sustainability goals. As production technologies evolve, the market is likely to witness increased competition and lower prices, fostering growth. This trend is expected to support the overall market expansion, contributing to the projected CAGR of 11.9% from 2025 to 2035.