Growing Demand in Wastewater Treatment

The Industrial Hydrogen Peroxide Market is witnessing a surge in demand driven by its applications in wastewater treatment. Hydrogen peroxide is utilized as an effective oxidizing agent for the treatment of industrial effluents, helping to break down organic pollutants and improve water quality. The increasing regulatory pressure on industries to manage wastewater effectively is propelling the adoption of hydrogen peroxide in treatment processes. In recent years, the market for hydrogen peroxide in wastewater treatment has expanded, with estimates suggesting a growth rate of approximately 6% annually. This trend underscores the importance of hydrogen peroxide in achieving compliance with environmental regulations and promoting sustainable water management practices.

Sustainable Practices in Manufacturing

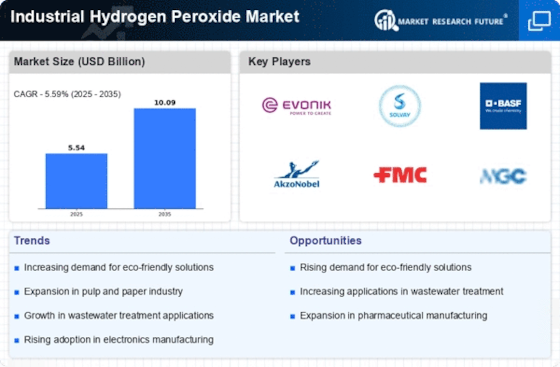

The Industrial Hydrogen Peroxide Market is experiencing a notable shift towards sustainable manufacturing practices. As industries increasingly prioritize environmental responsibility, hydrogen peroxide is recognized for its eco-friendly properties. It serves as a powerful oxidizing agent, facilitating the reduction of harmful emissions and waste. The market is projected to grow as companies adopt hydrogen peroxide for its ability to replace more hazardous chemicals in various applications. In 2023, the market size for industrial hydrogen peroxide reached approximately USD 3 billion, with a compound annual growth rate (CAGR) of around 5% expected over the next several years. This trend indicates a growing preference for sustainable solutions, positioning hydrogen peroxide as a key player in the transition towards greener industrial processes.

Technological Advancements in Production

Technological advancements in the production of hydrogen peroxide are significantly influencing the Industrial Hydrogen Peroxide Market. Innovations in production methods, such as the anthraquinone process, have enhanced efficiency and reduced costs. These advancements not only improve the yield of hydrogen peroxide but also minimize energy consumption, making production more sustainable. As of 2023, the production capacity of hydrogen peroxide has expanded, with several manufacturers investing in state-of-the-art facilities. This increase in capacity is expected to meet the rising demand across various sectors, including textiles, pulp and paper, and electronics. The integration of automation and digital technologies in production processes further streamlines operations, potentially leading to a more competitive market landscape.

Expanding Use in the Pharmaceutical Industry

The Industrial Hydrogen Peroxide Market is benefiting from the expanding use of hydrogen peroxide in the pharmaceutical sector. Its applications range from sterilization of medical equipment to the synthesis of active pharmaceutical ingredients. The increasing focus on health and safety, particularly in the wake of heightened hygiene standards, is driving pharmaceutical companies to utilize hydrogen peroxide for its antimicrobial properties. The market for hydrogen peroxide in pharmaceuticals is projected to grow steadily, with estimates suggesting a CAGR of around 4% over the next few years. This growth reflects the critical role hydrogen peroxide plays in ensuring the safety and efficacy of pharmaceutical products, thereby enhancing its importance in the industrial landscape.

Rising Applications in the Food and Beverage Sector

The Industrial Hydrogen Peroxide Market is experiencing growth due to its rising applications in the food and beverage sector. Hydrogen peroxide is employed as a disinfectant and bleaching agent, ensuring food safety and quality. The increasing consumer awareness regarding hygiene and safety standards is driving food manufacturers to adopt hydrogen peroxide for sanitization processes. In 2023, the food and beverage segment accounted for a significant share of the hydrogen peroxide market, with projections indicating continued growth as more companies recognize its efficacy. This trend highlights the versatility of hydrogen peroxide, positioning it as a crucial component in maintaining food safety and extending shelf life.