Investment in Hydrogen Technologies

Investment in hydrogen technologies is a pivotal driver for the Hydrogen Infrastructure Market. Governments and private entities are allocating substantial funds to develop hydrogen production, storage, and transportation technologies. For instance, the European Union has earmarked billions for hydrogen initiatives as part of its Green Deal. This financial commitment is expected to accelerate the deployment of hydrogen infrastructure, enhancing its viability as a mainstream energy source. Furthermore, advancements in electrolysis and fuel cell technologies are likely to improve efficiency and reduce costs, thereby fostering greater adoption of hydrogen solutions across various sectors, including transportation and industry.

Regulatory Frameworks and Incentives

The establishment of regulatory frameworks and incentives is crucial for the Hydrogen Infrastructure Market. Policymakers are increasingly recognizing the importance of hydrogen in achieving energy transition goals. Various countries are implementing supportive regulations and financial incentives to encourage investment in hydrogen infrastructure. For example, tax credits and subsidies for hydrogen production and usage are becoming more common. These measures not only stimulate market growth but also provide a stable environment for investors. As a result, the Hydrogen Infrastructure Market is poised for expansion, as regulatory support enhances the attractiveness of hydrogen as a clean energy alternative.

Decarbonization of Industrial Processes

The decarbonization of industrial processes is a significant driver for the Hydrogen Infrastructure Market. Industries such as steel, cement, and chemicals are under pressure to reduce their carbon footprints. Hydrogen is emerging as a key enabler for achieving these decarbonization targets, as it can replace fossil fuels in high-temperature processes. The Hydrogen Infrastructure Market is likely to benefit from this trend, as industries invest in hydrogen-based solutions to meet regulatory requirements and consumer expectations. Reports suggest that the industrial sector could account for a substantial portion of hydrogen demand, further propelling the growth of hydrogen infrastructure.

Growing Demand for Clean Energy Solutions

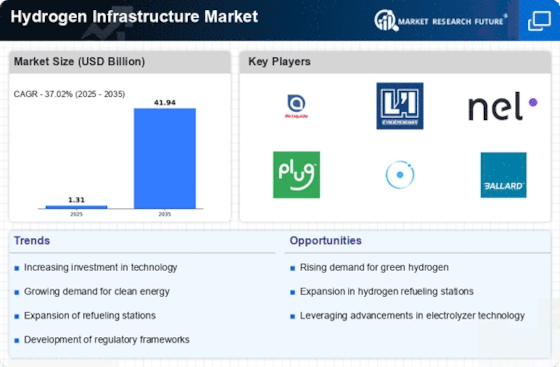

The Hydrogen Infrastructure Market is experiencing a surge in demand for clean energy solutions, driven by the global shift towards sustainability. As countries strive to meet their climate goals, hydrogen is increasingly recognized as a viable alternative to fossil fuels. The International Energy Agency indicates that hydrogen could account for up to 18% of the world's energy demand by 2050. This growing interest in hydrogen as a clean energy source is prompting investments in infrastructure development, including production, storage, and distribution facilities. Consequently, the Hydrogen Infrastructure Market is likely to expand significantly, as stakeholders seek to capitalize on the transition to a low-carbon economy.

Public Awareness and Acceptance of Hydrogen Technologies

Public awareness and acceptance of hydrogen technologies are increasingly influencing the Hydrogen Infrastructure Market. As educational initiatives and media coverage highlight the benefits of hydrogen as a clean energy source, consumer interest is growing. This heightened awareness is likely to drive demand for hydrogen-powered vehicles and other applications. Moreover, as more individuals and businesses recognize the potential of hydrogen to contribute to sustainability goals, the market for hydrogen infrastructure is expected to expand. The positive perception of hydrogen technologies could lead to increased investments and support from both the public and private sectors, further bolstering the Hydrogen Infrastructure Market.