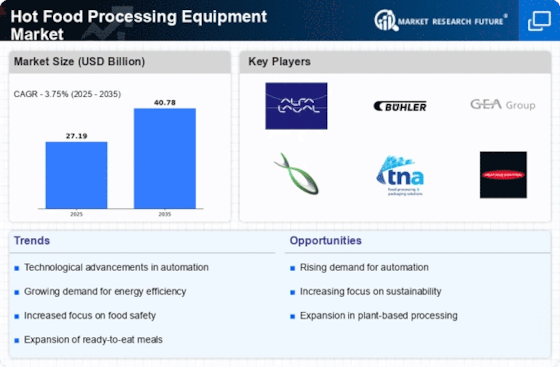

Health and Wellness Trends

The growing focus on health and wellness among consumers is influencing the Hot food processing Equipment Market. As individuals become more health-conscious, there is a rising demand for equipment that can facilitate the preparation of healthier food options. This includes equipment designed for steaming, grilling, and baking, which are perceived as healthier cooking methods compared to frying. Market data suggests that the health food segment is expanding rapidly, with an expected growth rate of 6% in the coming years. This shift is prompting manufacturers to develop processing equipment that aligns with health trends, thereby capturing a larger share of the market.

Expansion of Food Service Industry

The expansion of the food service industry is a pivotal driver in the Hot Food Processing Equipment Market. With the proliferation of restaurants, cafes, and food trucks, there is an increasing need for efficient and reliable food processing equipment. This sector is experiencing robust growth, with estimates suggesting a compound annual growth rate of around 5.5% over the next few years. As food service establishments strive to enhance their operational efficiency and meet consumer demands for quality and speed, the demand for advanced hot food processing equipment is expected to rise. This trend presents opportunities for manufacturers to innovate and cater to the specific needs of the food service sector.

Rising Demand for Convenience Foods

The increasing consumer preference for convenience foods is a notable driver in the Hot Food Processing Equipment Market. As lifestyles become busier, there is a growing inclination towards ready-to-eat meals and quick-service options. This trend has led to a surge in the demand for efficient food processing equipment that can handle high volumes while maintaining quality. According to industry reports, the convenience food sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. Consequently, manufacturers of hot food processing equipment are likely to innovate and adapt their offerings to meet this demand, thereby enhancing their market presence.

Regulatory Compliance and Food Safety Standards

Regulatory compliance and stringent food safety standards are significant drivers in the Hot Food Processing Equipment Market. Governments and health organizations worldwide are implementing rigorous regulations to ensure food safety and quality. This has led food manufacturers to invest in advanced processing equipment that meets these standards. The demand for equipment that can provide traceability, reduce contamination risks, and ensure consistent quality is on the rise. As a result, the market for hot food processing equipment is likely to expand, with projections indicating a growth rate of approximately 4% as companies seek to comply with evolving regulations.

Technological Advancements in Processing Equipment

Technological advancements play a crucial role in shaping the Hot Food Processing Equipment Market. Innovations such as automation, artificial intelligence, and IoT integration are transforming traditional food processing methods. These technologies not only improve efficiency but also enhance product consistency and safety. For instance, automated cooking systems can reduce labor costs and minimize human error, which is increasingly appealing to food manufacturers. The market for smart food processing equipment is expected to witness a significant uptick, with estimates suggesting a growth rate of around 5% annually. This trend indicates a shift towards more sophisticated processing solutions that cater to evolving consumer preferences.