Hospital Bed Market Summary

As per Market Research Future analysis, the Hospital Beds Market Size was estimated at 4.2 USD Billion in 2024. The Hospital Beds industry is projected to grow from 4.44 USD Billion in 2025 to 7.744 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.72% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Hospital Beds Market is experiencing a dynamic shift towards technological integration and home healthcare solutions.

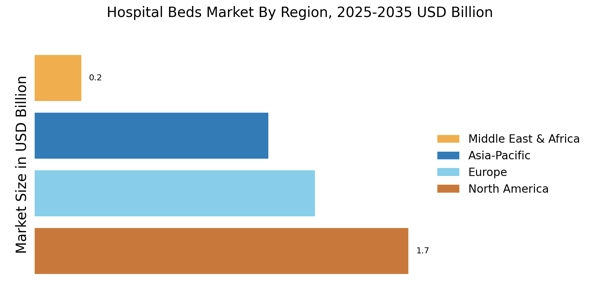

- North America remains the largest market for hospital beds, driven by advanced healthcare infrastructure and high expenditure.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by increasing healthcare demands and population growth.

- The Acute Care segment continues to dominate the market, while the Long-Term Care segment is witnessing rapid expansion due to changing patient needs.

- Technological advancements and the aging population are key drivers propelling the demand for hospital beds, particularly in electric and semi-electric segments.

Market Size & Forecast

| 2024 Market Size | 4.2 (USD Billion) |

| 2035 Market Size | 7.744 (USD Billion) |

| CAGR (2025 - 2035) | 5.72% |

Major Players

Hill-Rom (US), Stryker (US), Invacare (US), Arjo (SE), Medline Industries (US), Graham-Field Health Products (US), Drive DeVilbiss Healthcare (US), Linet (CZ), Karma Healthcare (IN)