Rising Healthcare Expenditure

The hospital bed market is experiencing growth due to the increasing healthcare expenditure in the US. As healthcare spending rises, hospitals are investing more in advanced medical equipment, including hospital beds. In 2025, healthcare expenditure is projected to reach approximately $4.5 trillion, which indicates a robust demand for modern hospital infrastructure. This trend is likely to drive the hospital bed market as facilities seek to enhance patient care and operational efficiency. Furthermore, the shift towards value-based care models necessitates the use of high-quality hospital beds that can accommodate various patient needs, thereby propelling market growth. The hospital bed market is thus positioned to benefit from this upward trajectory in healthcare spending.

Expansion of Healthcare Facilities

The expansion of healthcare facilities across the US is a significant driver for the hospital bed market. As new hospitals and clinics are established, there is a corresponding need for hospital beds to equip these facilities. The US is witnessing a trend towards the construction of more healthcare facilities, particularly in underserved areas, which is likely to increase the demand for hospital beds. In 2025, the hospital bed market is expected to benefit from this expansion, with a projected increase in bed installations. This growth is indicative of a broader commitment to improving healthcare access and quality, thereby driving the market forward.

Increased Focus on Infection Control

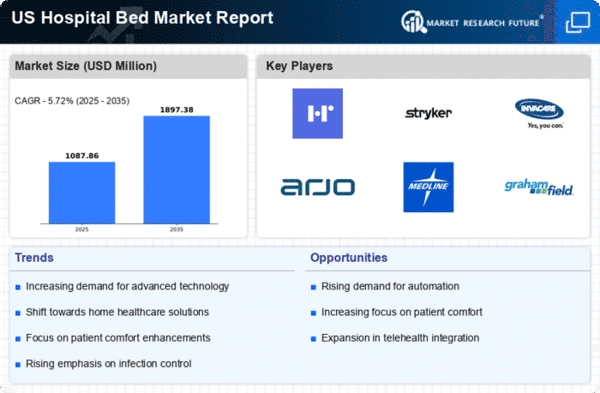

Infection control has become a critical concern in healthcare settings, significantly impacting the hospital bed market. The demand for beds that are easy to clean and made from antimicrobial materials is on the rise. Hospitals are increasingly prioritizing infection prevention strategies, which include the use of specialized hospital beds designed to minimize the risk of hospital-acquired infections. The market for such beds is projected to grow as healthcare facilities adopt stringent infection control protocols. In 2025, it is estimated that the hospital bed market will see a notable increase in sales of beds that meet these infection control standards, reflecting a broader trend towards enhancing patient safety and care quality.

Shift Towards Home Healthcare Solutions

The shift towards home healthcare solutions is influencing the hospital bed market in notable ways. As more patients prefer receiving care at home, there is a growing demand for home hospital beds that provide comfort and safety. This trend is supported by the increasing aging population and the desire for personalized care. The home healthcare market is projected to grow significantly, with estimates suggesting a CAGR of around 10% from 2025 to 2030. Consequently, the hospital bed market is likely to adapt by offering products that cater to this segment, including adjustable beds and those designed for ease of use in home settings.

Technological Integration in Healthcare

The integration of technology in healthcare is a pivotal driver for the hospital bed market. Innovations such as smart beds equipped with sensors and monitoring systems are becoming increasingly prevalent. These beds can track patient vitals, adjust positions automatically, and enhance overall patient comfort. The market for smart hospital beds is expected to grow at a CAGR of around 15% from 2025 to 2030, reflecting the increasing demand for technologically advanced solutions. Hospitals are recognizing the importance of these innovations in improving patient outcomes and operational efficiency. Consequently, the hospital bed market is likely to see a surge in demand for technologically integrated beds, which can provide real-time data and enhance patient safety.