Increasing Urbanization

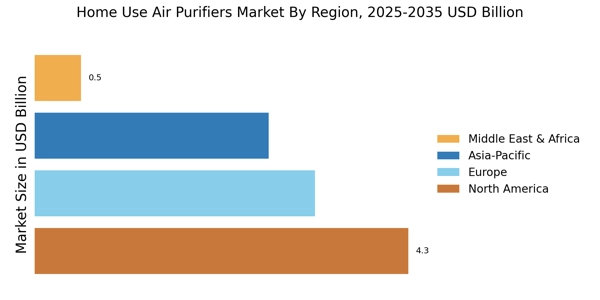

The trend of increasing urbanization appears to be a significant driver for the home use air purifiers Market. As more individuals migrate to urban areas, the levels of air pollution tend to rise, leading to a heightened awareness of indoor air quality. Urban environments often experience higher concentrations of pollutants, which can adversely affect health. Consequently, consumers are increasingly seeking solutions to mitigate these effects, thereby driving demand for air purifiers. According to recent data, urban populations are projected to reach 68% by 2050, suggesting a growing market for air purification solutions. This urban shift may lead to a greater emphasis on home air quality, positioning air purifiers as essential household items in densely populated regions.

Technological Advancements

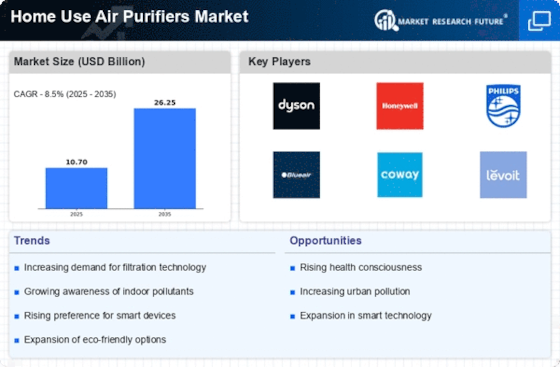

Technological advancements in air purification technology are poised to drive the Home Use Air Purifiers Market significantly. Innovations such as HEPA filters, activated carbon filters, and UV-C light technology enhance the efficiency of air purifiers in removing harmful particles and pathogens from indoor air. The integration of smart technology, including app connectivity and air quality monitoring, further appeals to tech-savvy consumers. As these technologies evolve, they are likely to become more accessible and affordable, expanding the market reach. The introduction of energy-efficient models also aligns with consumer preferences for sustainable products, potentially increasing market penetration. This technological evolution suggests a promising future for the air purifier market, as consumers increasingly seek advanced solutions for maintaining healthy indoor environments.

Consumer Awareness and Education

Consumer awareness and education regarding the importance of indoor air quality are crucial drivers for the Home Use Air Purifiers Market. As individuals become more informed about the health risks associated with poor air quality, they are more likely to invest in air purification solutions. Educational campaigns and information dissemination through various media channels have contributed to a growing understanding of how air purifiers can improve health outcomes. This heightened awareness is reflected in market trends, with a notable increase in online searches and inquiries about air purification products. As consumers prioritize health and wellness, the demand for air purifiers is expected to rise, indicating a robust market potential for manufacturers and retailers in the coming years.

Regulatory Support and Standards

Regulatory support and standards for air quality are emerging as significant drivers for the Home Use Air Purifiers Market. Governments and health organizations are increasingly recognizing the importance of maintaining healthy indoor environments, leading to the establishment of guidelines and standards for air quality. These regulations often encourage the use of air purifiers in residential settings, particularly in areas with high pollution levels. Compliance with these standards not only enhances consumer confidence but also drives manufacturers to innovate and improve their products. As regulatory frameworks evolve, they are likely to create a more favorable environment for the air purifier market, potentially leading to increased sales and market growth as consumers seek compliant and effective solutions for their homes.

Rising Allergies and Respiratory Issues

The prevalence of allergies and respiratory issues is another critical driver for the Home Use Air Purifiers Market. With an increasing number of individuals suffering from conditions such as asthma and allergic rhinitis, the demand for air purifiers is likely to rise. Studies indicate that approximately 30% of adults and 40% of children experience allergic reactions, often exacerbated by indoor air pollutants. This growing health concern prompts consumers to invest in air purification systems to improve their living environments. The market for air purifiers is projected to grow at a compound annual growth rate of around 10% over the next few years, reflecting the urgent need for effective solutions to enhance indoor air quality and alleviate health issues associated with poor air quality.