CareVoyant: Home Health Care Trends for 2025: In December 2024, CareVoyant, a provider of home care software, published an article on emerging trends for 2025. This article highlights "Workforce Challenges" and emphasizes that home care agencies should "reimagine how employees are hired and retained by offering training programs, competitive wages, and benefits." It also advocates for leveraging technology, AI, and automation to "automate repetitive tasks to improve productivity, quality of care, employee satisfaction, and work-life balance." It sheds some light on the growth of the home healthcare software market.

These points directly relate to improving the occupational health and well-being of home healthcare workers, addressing issues like burnout and physical strain. The article also mentions the importance of managing "regulatory and reimbursement challenges" which indirectly impact how agencies can invest in occupational health for their staff.

Dassault Systèmes: "Virtual Twin Evolutions Are Accelerating Healthcare Innovation; Dassault Systèmes to Show How at CES 2024": While technically published in December 2024, this press release from Dassault Systèmes for CES 2024 (which took place in January 2025) is highly relevant. It details their strong focus on "human virtual twin innovations" leveraging AI to set a new standard for precision healthcare.

They explicitly mention demonstrating the power of their collaborative Living Heart and Living Brain projects, as well as their MEDIDATA clinical trials virtualization solutions. The press release highlights how virtual twins are "replacing humans as test subjects in clinical trials" and their collaboration with the FDA through the ENRICHMENT project to set new standards in clinical research. This demonstrates a comprehensive and multi-faceted approach to digital twins across R&D and clinical application.

Ansys: Ansys 2025 R1: Ansys Digital Twin What's New Webinar: In March 2025, Ansys promoted a webinar detailing the new features in their Ansys 2025 R1 software release. This update "takes digital twin capabilities to the next level with hybrid analytics, scaled deployment, and usability enhancements."

Key highlights for digital twins include support for a unified installer, improved error and uncertainty quantification for Reduced Order Models (ROMs), and advancements in power electronics and electrification which often apply to medical devices. This shows continuous product development directly enhancing their digital twin offerings.

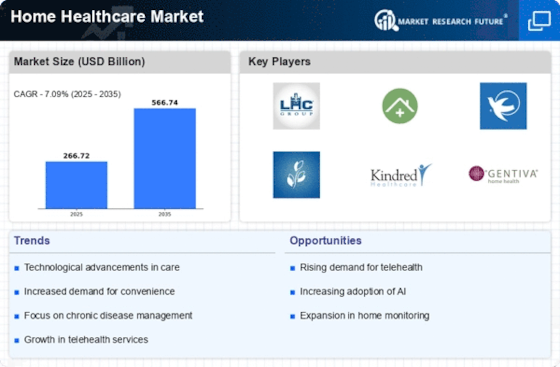

In recent developments within the Global Home Healthcare Market, several key companies are prominently making strides. UnitedHealth Group and Cigna have been expanding their telehealth services, focusing on enhancing patient accessibility and care quality.

Moreover, LHC Group and Encompass Health have reported a substantial increase in demand for home health services, reflecting a growing trend toward at-home care solutions. Several mergers and acquisitions have also reshaped the landscape; for instance, in September 2023, Amedisys announced the acquisition of a regional home health provider, strengthening its market position. Similarly, in August 2023, HealthSouth acquired additional rehabilitation care facilities, further diversifying its service offerings.

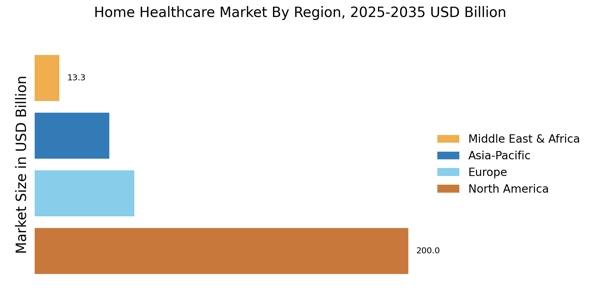

The home care market valuation of companies like Kindred Healthcare and Visiting Angels has shown significant growth, attributed to the rising elderly population and increasing prevalence of chronic illnesses. Over the past few years, the market has experienced a surge, particularly highlighted in June 2022 when the global home healthcare segment was valued at over $400 billion, underlining the sector's critical role in healthcare delivery. This trend is expected to continue as the demand for personalized and accessible healthcare solutions rises globally.