Rising Chronic Disease Prevalence

The increasing prevalence of chronic diseases in the US is a pivotal driver for the home healthcare market. Conditions such as diabetes, heart disease, and respiratory disorders necessitate ongoing care and monitoring, which can be effectively managed at home. According to the Centers for Disease Control and Prevention (CDC), approximately 60% of adults in the US live with at least one chronic condition. This trend underscores the demand for home healthcare services, as patients seek to manage their health in a familiar environment. The home healthcare market is thus positioned to expand, catering to the needs of these patients who require regular medical attention and support, ultimately reducing hospital readmissions and improving quality of life.

Increased Focus on Preventive Care

There is a notable shift towards preventive care within the home healthcare market, driven by a growing awareness of health management. Patients and healthcare providers alike recognize the benefits of early intervention and regular monitoring to prevent complications associated with chronic conditions. This trend is supported by initiatives from the US government aimed at reducing healthcare costs and improving population health. The home healthcare market is thus experiencing a surge in demand for services that emphasize preventive measures, such as health screenings and wellness programs. By focusing on prevention, the industry not only enhances patient outcomes but also contributes to a more sustainable healthcare system, potentially reducing overall healthcare expenditures.

Growing Demand for Personalized Care

The increasing demand for personalized care is reshaping the landscape of the home healthcare market. Patients are increasingly seeking tailored healthcare solutions that cater to their unique needs and preferences. This trend is particularly evident among the aging population, who often require customized care plans that address their specific health conditions and lifestyle choices. The home healthcare market is responding by offering a range of services that can be adapted to individual patient requirements, including specialized nursing care, therapy services, and companionship. As the emphasis on personalized care continues to grow, the industry is likely to see an uptick in service utilization, as patients feel more empowered to take control of their health in a home environment.

Technological Integration in Healthcare

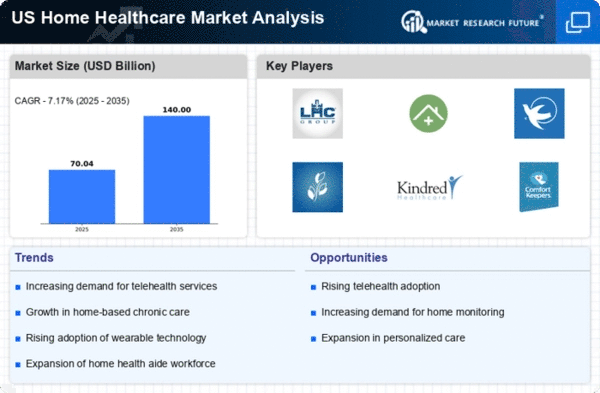

The integration of advanced technologies into the home healthcare market is transforming service delivery. Innovations such as telehealth, remote monitoring devices, and mobile health applications enable healthcare providers to offer real-time support and monitoring to patients in their homes. The market for telehealth services alone is projected to reach $250 billion by 2025, reflecting a growing acceptance of technology in healthcare. This technological shift not only enhances patient engagement but also improves health outcomes by facilitating timely interventions. As the home healthcare market continues to embrace these advancements, it is likely to attract a broader demographic, including younger patients who are more tech-savvy and prefer receiving care in a home setting.

Supportive Policies and Reimbursement Models

The evolution of supportive policies and reimbursement models is significantly influencing the home healthcare market. Recent legislative changes have expanded coverage for home healthcare services, making them more accessible to a larger segment of the population. For instance, Medicare has broadened its coverage criteria, allowing more patients to receive home health services. This shift is expected to drive growth in the home healthcare market, as more individuals seek care in their homes rather than in institutional settings. Additionally, the introduction of value-based care models incentivizes providers to focus on patient outcomes, further promoting the adoption of home healthcare services. As these policies continue to evolve, they are likely to create a more favorable environment for the industry.