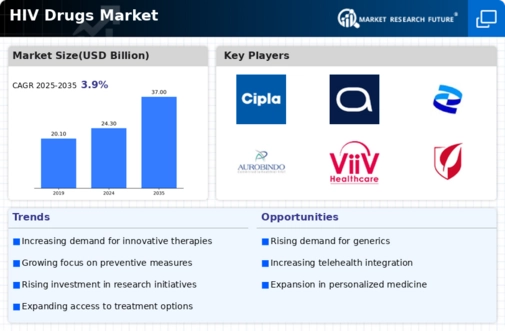

North America : Market Leader in HIV Treatment

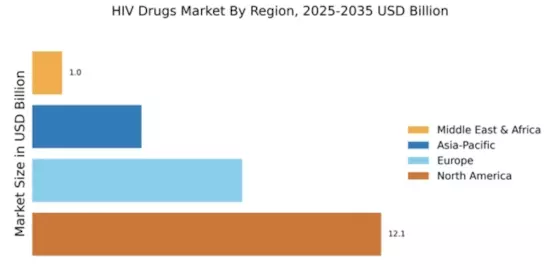

North America continues to lead the HIV drugs market, holding a significant share of 12.14 in 2024. The region's growth is driven by advanced healthcare infrastructure, high prevalence of HIV, and increasing investments in research and development. Regulatory support, including streamlined approval processes for new therapies, further fuels market expansion. The demand for innovative treatments, particularly long-acting injectables, is on the rise, reflecting a shift towards more effective management of HIV. The competitive landscape in North America is robust, featuring key players such as Gilead Sciences, Merck & Co., and Johnson & Johnson. These companies are at the forefront of developing cutting-edge therapies, contributing to the region's market dominance. The presence of established pharmaceutical firms ensures a steady supply of effective treatments, while ongoing collaborations and partnerships enhance innovation. As the market evolves, the focus on personalized medicine and patient-centric approaches is expected to shape future growth.

Europe : Emerging Market with Growth Potential

Europe's HIV drugs market is poised for growth, with a market size of 7.3 in 2024. The region benefits from strong healthcare systems and a commitment to public health initiatives aimed at reducing HIV transmission. Regulatory frameworks, such as the European Medicines Agency's guidelines, support the introduction of new therapies, enhancing treatment accessibility. Increasing awareness and education about HIV are also driving demand for effective treatments, contributing to market expansion. Leading countries in Europe include the UK, Germany, and France, where significant investments in healthcare infrastructure are evident. Major players like ViiV Healthcare and Roche are actively involved in the market, focusing on innovative solutions to improve patient outcomes. The competitive landscape is characterized by collaborations between pharmaceutical companies and healthcare providers, aimed at enhancing treatment strategies. As the market evolves, the emphasis on preventive measures and early diagnosis will play a crucial role in shaping future trends.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region is witnessing a burgeoning HIV drugs market, with a size of 3.8 in 2024. Key growth drivers include increasing HIV prevalence, rising healthcare expenditure, and government initiatives aimed at improving access to treatment. Regulatory bodies are actively working to streamline drug approvals, which is expected to enhance the availability of innovative therapies. The growing awareness of HIV and its treatment options is also contributing to market demand, reflecting a positive trend in public health initiatives. Countries like India, China, and Australia are leading the charge in the Asia-Pacific market, with significant investments from both local and international pharmaceutical companies. Key players such as Teva Pharmaceutical Industries and AbbVie are focusing on expanding their product portfolios to meet the diverse needs of patients. The competitive landscape is evolving, with an increasing emphasis on partnerships and collaborations to drive innovation and improve treatment outcomes. As the market matures, the focus on affordable and accessible therapies will be paramount.

Middle East and Africa : Emerging Market with Challenges

The Middle East and Africa region represents an emerging market for HIV drugs, with a market size of 1.04 in 2024. The growth is primarily driven by increasing awareness of HIV, government initiatives to combat the epidemic, and international funding for healthcare programs. However, challenges such as limited access to healthcare and varying regulatory environments can hinder market growth. Efforts to improve healthcare infrastructure and enhance treatment accessibility are crucial for the region's development. Leading countries in this region include South Africa and Nigeria, where significant efforts are being made to address the HIV epidemic. Key players like Gilead Sciences and Merck & Co. are actively involved in providing treatments and support. The competitive landscape is characterized by collaborations between governments, NGOs, and pharmaceutical companies to improve patient access to therapies. As the market evolves, the focus on education and prevention will be essential for sustainable growth.