Advancements in LED Technology

The High Purity Ultra Pure Ga Market is benefiting from advancements in light-emitting diode (LED) technology. Gallium nitride (GaN), derived from high-purity gallium, is a key material in the production of LEDs, which are increasingly favored for their energy efficiency and longevity. The LED market is projected to reach approximately 100 billion USD by 2025, driven by demand across various sectors, including automotive, consumer electronics, and general lighting. This trend underscores the importance of high-purity gallium in the High Purity Ultra Pure Ga Market, as manufacturers strive to enhance the performance and reliability of LED products.

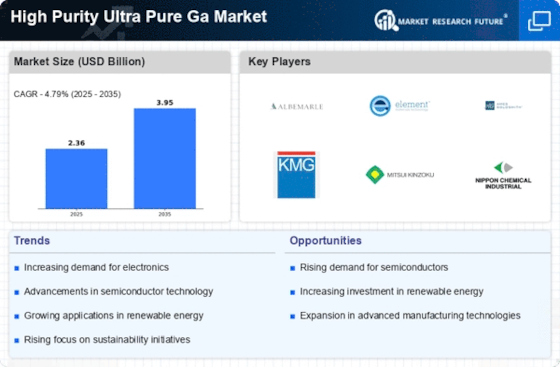

Growth in Renewable Energy Technologies

The High Purity Ultra Pure Ga Market is poised for expansion, driven by the increasing adoption of renewable energy technologies. Gallium is integral to the production of photovoltaic cells used in solar panels, which are gaining traction as sustainable energy solutions. The High Purity Ultra Pure Ga is expected to surpass 200 billion USD by 2025, with gallium-based materials contributing significantly to efficiency improvements. This growth in renewable energy applications suggests a favorable outlook for the High Purity Ultra Pure Ga Market, as manufacturers align their production capabilities to meet the rising demand for high-purity gallium in solar technology.

Regulatory Support for Advanced Materials

The High Purity Ultra Pure Ga Market is likely to benefit from increasing regulatory support aimed at promoting advanced materials. Governments are recognizing the importance of high-purity materials in fostering innovation and competitiveness in technology sectors. Initiatives that encourage research and development in materials science, particularly those involving gallium, are expected to bolster the market. As regulations evolve to support sustainable and efficient manufacturing practices, the High Purity Ultra Pure Ga Market may see enhanced investment and growth opportunities, aligning with broader economic goals of technological advancement and environmental sustainability.

Rising Demand for High-Performance Electronics

The High Purity Ultra Pure Ga Market is witnessing a surge in demand for high-performance electronics, particularly in telecommunications and computing. As 5G technology continues to roll out, the need for high-purity gallium in the production of high-frequency devices is becoming increasingly critical. The telecommunications equipment market is expected to grow significantly, potentially reaching 500 billion USD by 2025. This growth is likely to drive the demand for high-purity gallium, as manufacturers seek to produce components that can operate efficiently at higher frequencies, thereby enhancing the overall performance of electronic systems within the High Purity Ultra Pure Ga Market.

Increasing Applications in Semiconductor Industry

The High Purity Ultra Pure Ga Market is experiencing a notable surge in demand due to its critical applications in the semiconductor sector. As the industry evolves, the need for high-purity gallium, which is essential for the production of gallium arsenide (GaAs) and other semiconductor materials, becomes increasingly pronounced. In 2025, the semiconductor market is projected to reach approximately 600 billion USD, with gallium-based components playing a pivotal role in enhancing the performance of electronic devices. This trend indicates a robust growth trajectory for the High Purity Ultra Pure Ga Market, as manufacturers seek to meet the stringent purity requirements necessary for advanced semiconductor applications.