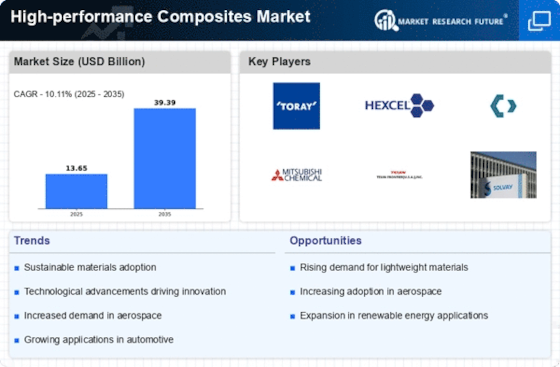

Top Industry Leaders in the High-performance Composites Market

The high-performance composites market, a dynamic arena for advanced materials, driven by relentless innovation, surging demand across diverse industries, and a relentless pursuit of lightweight and efficient solutions. This landscape is characterized by intense competition, with established players and nimble newcomers vying for market share. Let's delve into the key strategies, market dynamics, and recent developments shaping this high-growth market.

Strategies Fueling Market Share:

-

Product Diversification: Leading players like Toray Industries, Hexcel, and Solvay are expanding their portfolios beyond traditional thermoset composites, embracing thermoplastics and bio-based composites to cater to evolving sustainability needs. -

Vertical Integration: Companies like SGL Group and Koninklijke Ten Cate are investing in upstream fiber production and downstream manufacturing, ensuring greater control over the supply chain and cost-effectiveness. -

Technological Prowess: Continuous R&D holds paramount importance. BASF, for example, is focusing on developing next-generation carbon fiber variants and advanced resin systems for enhanced performance and recyclability. -

Strategic Partnerships: Collaborations between established players and startups are fostering rapid innovation. Arkema partnered with Impossible Composites to develop high-performance 3D-printable composites, while Albany International is working with Boeing on advanced aerospace applications. -

Regional Expansion: Asia-Pacific, with its booming automotive and aerospace industries, is attracting significant investments. Chinese players like Jiangsu Hengshen and Jushi Group are expanding their global reach, challenging the dominance of established European and American companies.

Market Share Determinants:

-

Fiber Type: Carbon fiber remains the dominant player due to its superior strength-to-weight ratio, but glass and aramid fibers are gaining traction in cost-sensitive applications. -

Resin Type: Thermoplastics are witnessing rapid adoption for their recyclability and ease of processing, but thermosets still hold a significant market share due to their superior heat resistance and stiffness. -

Application Industry: Aerospace & defense remains the primary driver, followed by automotive and wind energy. However, the construction and medical sectors are emerging as promising growth avenues. -

Geographical Distribution: North America currently holds the largest market share, but Asia-Pacific is expected to witness the fastest growth due to its burgeoning industrial landscape. -

Sustainability: The increasing focus on environmental responsibility is driving demand for bio-based composites and recyclable materials, creating new opportunities for innovative players.

Key Companies in the High-performance Composites market include

- BASF SE (Germany)

- SABIC (Saudi Arabia)

- Solvay (Belgium)

- Owens Corning (US)

- TPI Composites (US)

- Huntsman International LLC (US)

- TEIJIN LIMITED (Japan)

- SGL Group (Germany)

- Hexcel Corporation (US)

- Albany International Corporation (US)

- TORAY INDUSTRIES, INC. (Japan)

- Arkema (France)

- 3M (US)

- ARGOSY INTERNATIONAL (US)

- Northrop Grumman Corporation (US).

Recent Developments:

Nautec Group is acquired by MBCC Group December 2021; they produce ultra-high performance concrete and cement composites for repair, marine and wind turbines to ensure efficient solutions and satisfy customer demands in the market.

Hexcel Corporation and Fairmat, a deep technology company, have partnered to develop the capability of recycling carbon fiber prepreg from Hexcel European plants for use in commercial composite panels in November 2021.

The Toraysee Anti-Fog Cloth for Eyeglasses will go on sale in Oct 2021 Japan, starting mid-October, according to Toray Industries, Inc., while receiving this information.

In September 2020, Alliance Spacesystems, LLC was purchased by Applied Composites Holdings, LLC, as it sought to increase its product line for applications in automotive and aerospace, thereby achieving substantial business growth.