Expansion in Automotive Applications

The automotive industry is increasingly adopting high-performance composites to enhance vehicle performance and reduce weight, thereby improving fuel efficiency. The High-performance Composites Market is benefiting from this trend, as automakers strive to meet stringent emissions regulations and consumer demand for more efficient vehicles. Recent estimates suggest that the use of composites in automotive applications could grow by over 15% in the coming years, particularly in electric and hybrid vehicles. These materials not only contribute to weight reduction but also provide enhanced safety features and design flexibility. As automotive manufacturers continue to innovate and explore new composite applications, the high-performance composites market is poised for substantial growth, driven by the need for advanced materials that align with evolving industry standards.

Increasing Demand in Aerospace Sector

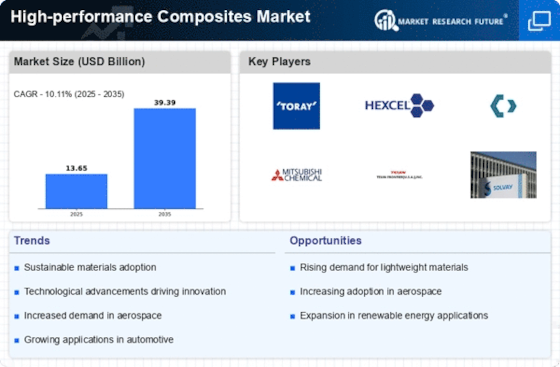

The aerospace sector is experiencing a notable surge in demand for high-performance composites, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. The High-performance Composites Market is projected to witness a compound annual growth rate of approximately 8% over the next few years, as manufacturers seek to replace traditional materials with advanced composites. This shift is largely attributed to the growing emphasis on sustainability and performance in aircraft design. Furthermore, the integration of high-performance composites in both commercial and military aircraft is expected to bolster market growth, as these materials offer superior strength-to-weight ratios and corrosion resistance. As a result, the aerospace industry is likely to remain a key driver for the high-performance composites market, influencing innovations and investments in composite technologies.

Growth in Defense and Military Applications

The defense and military sectors are increasingly recognizing the advantages of high-performance composites, which offer superior strength, lightweight properties, and resistance to harsh environments. The High-performance Composites Market is expected to see substantial growth as defense contractors incorporate these materials into various applications, including armored vehicles, aircraft, and naval vessels. Recent projections suggest that the defense sector's demand for high-performance composites could increase by approximately 10% annually, driven by the need for enhanced performance and operational efficiency. Additionally, the ongoing modernization of military equipment and the emphasis on advanced materials for strategic advantages are likely to further propel market growth. As defense budgets continue to allocate funds for innovative materials, the high-performance composites market is positioned to thrive in this sector.

Rising Demand for Renewable Energy Solutions

The increasing focus on renewable energy solutions is driving the demand for high-performance composites, particularly in wind energy applications. The High-performance Composites Market is benefiting from the need for lightweight and durable materials that can withstand harsh environmental conditions. Wind turbine manufacturers are increasingly utilizing composite materials for blades, which can enhance efficiency and longevity. Recent data indicates that the use of composites in wind energy applications is expected to grow by over 20% in the next few years, as the industry seeks to optimize performance and reduce costs. This trend is likely to create new opportunities for composite manufacturers, as the renewable energy sector continues to expand and innovate. The integration of high-performance composites in renewable energy technologies is poised to play a pivotal role in achieving sustainability goals.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are playing a crucial role in the growth of the high-performance composites market. Innovations such as automated fiber placement and 3D printing are enhancing production efficiency and reducing costs, making high-performance composites more accessible to various industries. The High-performance Composites Market is witnessing a transformation as these technologies enable the creation of complex geometries and tailored material properties. This shift is expected to attract new players and investments, further stimulating market growth. Additionally, the development of advanced resin systems and hybrid composites is likely to expand the application range of high-performance materials, particularly in sectors such as construction and consumer goods. As manufacturing technologies continue to evolve, the high-performance composites market is anticipated to experience significant advancements and opportunities.