High Intensity Sweeteners Size

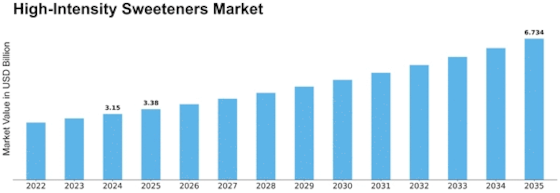

High-Intensity Sweeteners Market Growth Projections and Opportunities

The High-Intensity Sweeteners Market is influenced by a myriad of factors that contribute to its dynamics and growth in the food and beverage industry. One of the primary drivers of this market is the increasing global demand for low-calorie and sugar-free alternatives. As consumers become more health-conscious and seek ways to reduce sugar intake, high-intensity sweeteners offer a viable solution for sweetening products without the associated caloric content. The rising prevalence of lifestyle-related health issues, such as obesity and diabetes, has heightened awareness about the impact of excessive sugar consumption, driving the demand for high-intensity sweeteners across a wide range of food and beverage applications.

Consumer preferences for healthier alternatives and sugar reduction play a significant role in shaping the High-Intensity Sweeteners Market. The market has responded to this demand by offering a variety of high-intensity sweeteners, such as aspartame, sucralose, steviol glycosides (derived from the stevia plant), and others. These sweeteners provide the sweetness of sugar without the calories, making them attractive to consumers who are mindful of their dietary choices and sugar intake.

Economic factors, including income levels and affordability, play a crucial role in the High-Intensity Sweeteners Market. The cost-effectiveness of high-intensity sweeteners compared to sugar can influence consumer purchasing decisions, especially during periods of economic uncertainty. Food and beverage manufacturers may opt for high-intensity sweeteners as a cost-effective ingredient to formulate low-calorie and sugar-free products, providing consumers with more affordable alternatives to traditional sugar-sweetened products.

Supply chain dynamics and regulatory considerations are pivotal factors in the High-Intensity Sweeteners Market. The production and supply of high-intensity sweeteners involve adherence to strict quality standards and regulatory requirements to ensure product safety. Regulatory approvals and compliance with food safety regulations contribute to the market's stability and the confidence of consumers and industry stakeholders in the safety and efficacy of high-intensity sweeteners.

Technological advancements in sweetener formulations and product applications contribute to the growth and innovation within the High-Intensity Sweeteners Market. Ongoing research and development efforts focus on improving the taste profile, solubility, and stability of high-intensity sweeteners, addressing some of the challenges associated with certain sweeteners' aftertastes. The application of high-intensity sweeteners in a variety of food and beverage products, including beverages, dairy, confectionery, and baked goods, reflects the industry's commitment to providing diverse options for consumers seeking reduced-sugar alternatives.

Health and wellness considerations are critical influencers in the High-Intensity Sweeteners Market. With the increasing awareness of the health risks associated with excessive sugar consumption, high-intensity sweeteners serve as an integral component of the food industry's response to the demand for healthier alternatives. The market caters to consumers looking for options to manage weight, control blood sugar levels, and reduce the risk of dental issues associated with high sugar intake.

Cultural preferences and global dietary trends contribute to the High-Intensity Sweeteners Market's dynamics. Different regions have unique culinary traditions and preferences for sweetness intensity, influencing the types of high-intensity sweeteners used in various markets. Cultural shifts toward healthier eating habits and the global trend of reducing sugar intake further drive the adoption of high-intensity sweeteners as a versatile and widely accepted sweetening solution.

Leave a Comment