Hereditary Angioedema Therapeutics Size

Hereditary Angioedema Therapeutics Market Growth Projections and Opportunities

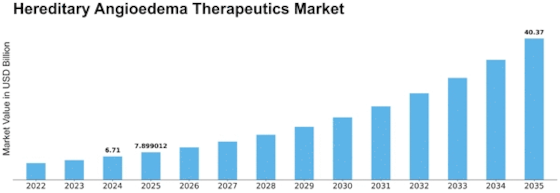

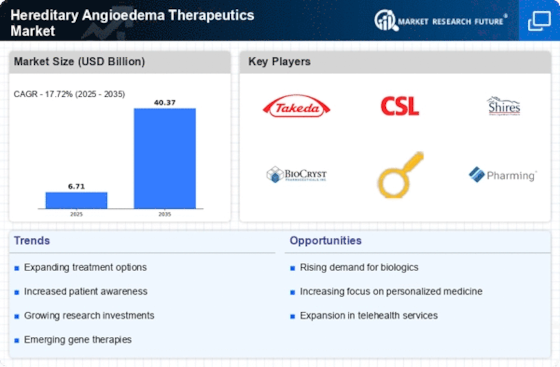

Hereditary Angioedema Therapeutics Market is going to reach USD 12.4 billion by 2032 with 17.7% CAGR during forecast period. The market of HAE (hereditary angioedema) therapeutics functions in an ever-changing environment where numerous factors play a role and ultimately define the course of its growth and development. HAE is a rare hereditary disease that presents with recurrences of intensive swelling in the skin, gastrointestinal tract, or airways. The observed economics are based on the growing incidence and diagnosis of HAE, therapy improvements, ongoing research, and disease management evolution.

A major factor determining the trajectory of the HAE Therapeutics Market is the increasing comprehension and enhanced diagnosis of Hereditary Angioedema. With the enlightenment campaigns and educational programs that are targeted to medical professionals and general populations there is increased diagnosis for HAE cases. One of the important aspects of effective management is early and accurate diagnosis, and the rise in awareness increases the demand for therapeutic options, which motivates research and development in this field.

Therapeutic innovations are central to the shaping of the HAE market dynamics. The treatment of HAE traditionally included managing the symptoms and the prevention of acute attacks. Nonetheless, progress in recent years includes the development of highly specific therapeutic options that are tailored to address the genetic basis of HAE. These innovative therapeutic choices consisting of C1 esterase inhibitors and bradykinin receptor antagonists gives more precise and efficient techniques to the doctors and patients for combating the HAE symptoms.

Constant ongoing research and development is the primary driving force which affects dynamics of HAE Therapeutics Market. Pharmaceutical companies and research institutions are actively participating in the search for new therapeutic approaches, improving the already existing treatments, and conducting clinical trials for the safety and efficacy of novel drugs. The race for novel and convenient treatment options which include long-acting formulation and self-administered therapies is among the reasons that leads to the progress of the HAE therapeutic landscape and the market dynamics.

The changing face of the rare disease management modifies the HAE market dynamics. Improvements in knowledge of the molecular and genetic aspects of rare diseases, such as HAE, are part of the creation of precision medicine based methods. Gene-targeted treatments that take into account the particular genetic mutations in HAE and the pathways that are affected by them result in more individualized and targeted therapeutic interventions.

Leave a Comment