Aging Population

The demographic shift towards an aging population is significantly impacting the Herbal Medicinal Products Market. As the global population ages, there is an increasing prevalence of chronic diseases and health conditions that require management. Older adults are often more inclined to seek natural remedies, as they may prefer alternatives to conventional pharmaceuticals. This demographic trend is reflected in market data, indicating that the herbal products sector is projected to grow at a compound annual growth rate of 7% over the next five years. The aging population's preference for herbal solutions is likely to drive innovation in product development, focusing on formulations that cater specifically to their health needs. Consequently, the Herbal Medicinal Products Market is poised to expand as it adapts to the preferences and requirements of this significant consumer segment.

Rise of E-commerce Platforms

The proliferation of e-commerce platforms is transforming the Herbal Medicinal Products Market by providing consumers with unprecedented access to a wide array of herbal products. Online shopping has become increasingly popular, particularly among younger demographics who value convenience and variety. This trend is supported by data indicating that online sales of herbal products have surged, accounting for nearly 25% of total sales in 2023. E-commerce not only facilitates easy access to products but also allows consumers to compare options and read reviews, enhancing their purchasing decisions. As more companies invest in online retail strategies, the Herbal Medicinal Products Market is likely to see accelerated growth. This shift towards digital platforms may also encourage brands to engage in targeted marketing, further expanding their reach and consumer base.

Increasing Consumer Awareness

The Herbal Medicinal Products Market is experiencing a notable surge in consumer awareness regarding the benefits of herbal remedies. As individuals become more informed about the potential side effects of synthetic medications, there is a growing inclination towards natural alternatives. This shift is evidenced by a reported increase in sales of herbal products, which reached approximately 30 billion USD in 2023. Consumers are actively seeking products that align with their health and wellness goals, thereby driving demand within the Herbal Medicinal Products Market. Furthermore, educational campaigns and social media influence are playing pivotal roles in disseminating information about herbal remedies, contributing to a more knowledgeable consumer base. This trend suggests that as awareness continues to rise, the market may witness sustained growth, potentially leading to innovations in product offerings and formulations.

Cultural Acceptance of Herbal Remedies

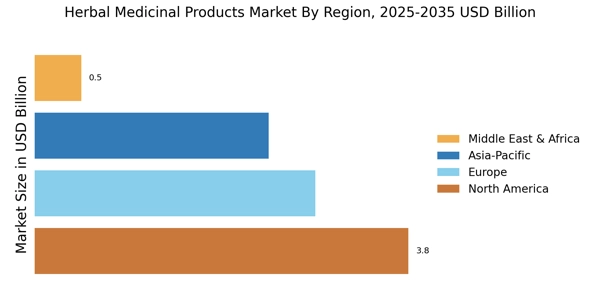

Cultural acceptance of herbal remedies is a pivotal driver for the Herbal Medicinal Products Market. In many regions, traditional herbal practices have been integrated into healthcare systems, fostering a strong consumer base that values these natural solutions. This cultural inclination towards herbal products is evident in market trends, where certain regions report higher consumption rates of herbal medicines. For instance, in Asia, herbal products account for a substantial portion of the healthcare market, reflecting deep-rooted traditions. As cultural acceptance continues to grow, the Herbal Medicinal Products Market is likely to expand, with increased investment in research and development to meet diverse consumer needs. This cultural shift may also encourage collaboration between traditional practitioners and modern healthcare providers, further legitimizing herbal remedies in contemporary health discussions.

Growing Interest in Preventive Healthcare

The Herbal Medicinal Products Market is benefiting from a growing interest in preventive healthcare among consumers. Individuals are increasingly prioritizing wellness and proactive health management, leading to a heightened demand for herbal products that support overall well-being. This trend is reflected in Market Research Future, which indicates that the preventive healthcare segment is expected to grow significantly, with herbal supplements playing a crucial role. Consumers are seeking products that not only address existing health issues but also promote long-term health benefits. This shift towards preventive measures is likely to drive innovation within the Herbal Medicinal Products Market, as companies develop new formulations that cater to health-conscious consumers. As awareness of preventive healthcare continues to rise, the market may experience sustained growth, with herbal products becoming integral to health management strategies.