January, 2023: Nucor Corp.’s new steel plate mill in Brandenburg, Ky., rolled its first steel plate on Dec. 30, 2022. Nucor Steel Brandenburg, a $1.7 billion capital investment with the ability to produce 1.2 million tons annually, will focus on final commissioning of the mill in the first quarter of 2023 and will ship the first tons to customers during the quarter.

Nucor Steel Brandenburg will be among only a few mills globally – and the only mill in the United States, according to the company – capable of manufacturing at scale the heavy-gauge plate used in monopile foundations for offshore wind towers.The recent passage of the Inflation Reduction Act, which included $300 billion for clean energy development and climate programs, supports the Biden Administration’s announced goal to build 30 gigawatts of offshore wind power by 2030. This could result in approximately 7.5 million tons of additional steel demand.

According to Nucor Steel Brandenburg, it will be able to produce 97% of plate products consumed domestically.November, 2022: Steel Dynamics Announces Planned State-of-the-Art Aluminum Flat Rolled Mill Site Selection - The planned $1.9 billion aluminum flat rolled mill is designed to have an annual production capacity of 650,000 tonnes of finished products, serving the sustainable beverage packaging, automotive, and common alloy industrial sectors. The product offering will be supported by various value-added finishing lines, including CASH (continuous annealing solutions heat treating) lines, continuous coating, and various slitting and packaging operations.

The rolling mill is currently expected to begin operations in mid-2025. The company's focus on decarbonization will also be applied to this aluminum operation, including plans to use a significant amount of pre- and post-consumer aluminum scrap in its production process, supported by the company's metals recycling platform, which is the largest nonferrous metals recycler in North America.

Heat-treated Steel Plates Market Competitive Landscape

The market includes tier-1, tier-2, and local players. The key market participants generally pursue new semiconductor metrology and inspection market categories. In manufacturing, specialized robots programmed for a particular work environment are generally preferable to standard robots. For instance, in February 2022, Tata Steel announced that it would purchase NeelachalIspat Nigam Ltd. The acquisition is probably going to increase the Tata Steel subsidiary's ability to produce long steel.

Prominent players in the heat-treated steel plates market include Essar Steel (India), SAIL (India), POSCO (South Korea), JFE Holding Inc. (Japan), Tata Steel (India), NLMK Group (Russia), ArcelorMittal (Luxembourg), Nippon Steel & Sumitomo Metal Corporation (Japan), Baosteel Group Hu (China), ThyssenKrupp AG (Germany), among others.

Scope of the Heat-treated Steel Plates Market Report

Type Outlook

Application Outlook

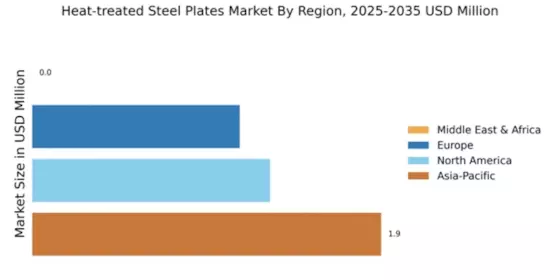

Region Outlook

- Asia-Pacific

- Australia and New Zealand

Objectives of the Study

The objectives of the study are summarized in 5 stages. They are as mentioned below:

Heat-Treated Steel Plates Market Forecast & Size:

To identify and estimate the market size for the heat-treated steel plates market report segmented by type and application by value (in US dollars). Also, to understand the consumption/ demand created by consumers of heat-treated steel plates market forecast between 2022 and 2030

Market Landscape and Trends:

To identify and infer the drivers, restraints, opportunities, and challenges in the heat-treated steel plates market.

Market Influencing Factors:

To find out the factors which are affecting the heat-treated steel plates market among consumers

Company Profiling:

To provide a detailed insight into the major companies operating in the market. The profiling will include the financial health of the company in the past 2-3 years with segmental and regional revenue breakup, product offering, recent developments, SWOT analysis, and key strategies.

Intended Audience

- Investors and Trade Experts

- Retailers, wholesalers, and distributors

- Governments, associations, and industrial bodies

- Investors and Trade Experts