Heat Treated Steel Plates Size

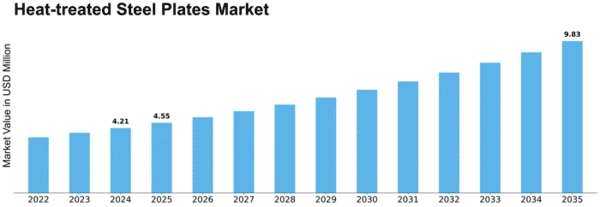

Heat-treated Steel Plates Market Growth Projections and Opportunities

The metal product of heat-treated steel plates is the subject of the market forces being responded to by a myriad of factors that make up its dynamics." The constantly growing construction industry is, essentially, one of the causes to this market. However, while the level of urbanization is going up around the world, so are the needs for high-strength steel plates in construction, which are growing at the same rate. Hammered steel plates, widely used due to their ability to withstand extreme stress and fatigue, are becoming more and more relevant components in buildings worldwide, which in turn leads to increased demand.

The automotive industry should also be taken into consideration on top of the mineral appliances which lead the heat-treated steel plates market. The demand on building cars lightweighting them to help raise fuel efficiency and also to adhere to the extreme environmental regulations is what is pushing the automotive industry to use advanced materials such as high-strength steel plates. These plates are a definitive combination of strength and low weight, which makes them paramount in the production of cars leading to lower energy consumption and lesser pollution.

In the second place among heat-treated steel plates market influencing factors, we may enumerate power industry. Given the rises in renewable electricity demand, there emerges a parallel requirement for strong and resistant construction mechanical materials in the building of wind turbines and solar panels. Through heat treatment the steel plates being one of the best mechanical properties takes place and thus become a part of these energy systems and move forward in the development of the market.

In addition, world economic trends along with the new trade policies also have a tremendous influence on the course of heat-treated steel plates market. Brief periods of fluctuations in currency exchange rates, trade tensions, and political situations at an international level can increase or decrease the cost of procurement of raw materials, production, and shipping. This ultimately affects the overall pricing and dynamics of the market. Companies that are situated into this market have to do the necessary navigation of those factors to be in a position of remaining competitive and of getting sustainable development.

Technology has a profound impact on the continuity of the increasingly changing market. Continuous R&D initiatives result in the invention of novel heat treatment procedures and add to the quality of special steel plates, which boosts the top potential of heat-treated steel plates. Incorporation of high-end technologies not only enhances the quality of the finished product, but will also be able help the manufacturers to cater to specific needs of the customer, thus making their products more acceptable by the market.

The environmental issues have been rapidly drawn the attention of the business activities as the different industries and the heat-treated steel plates industry also are not immune to it. As sustainability and reduced carbon footprint become bigger issues, more manufacturers will be required to apply ecofriendly mechanisms. In fact, consumers with these environmental values are also viewed as essential contributors to the revolution, an example is the pattern change.

Leave a Comment