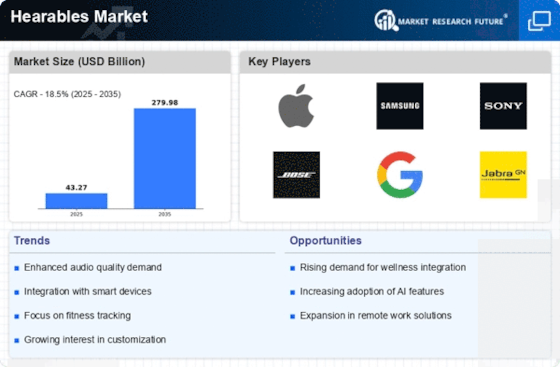

Integration of Smart Features

The integration of smart features into hearables is transforming the Hearables Market. Devices are increasingly equipped with functionalities such as voice assistants, fitness tracking, and augmented reality capabilities. This trend aligns with consumer preferences for multifunctional devices that enhance daily life. Market data reveals that hearables with smart features are experiencing higher adoption rates, as users seek devices that offer more than just audio playback. The potential for hearables to serve as health monitoring tools, providing insights into physical activity and wellness, further elevates their appeal. As technology continues to evolve, the Hearables Market is likely to see a proliferation of smart devices that cater to diverse consumer needs.

Advancements in Audio Technology

Technological advancements play a pivotal role in shaping the Hearables Market. Innovations in audio quality, such as noise cancellation and spatial audio, are becoming increasingly prevalent. These enhancements not only improve user experience but also attract audiophiles and casual listeners alike. Market data suggests that products featuring superior audio technology are commanding higher price points, indicating a willingness among consumers to invest in quality. Furthermore, the rise of high-resolution audio streaming services has created a demand for hearables that can deliver exceptional sound fidelity. As manufacturers continue to push the boundaries of audio technology, the Hearables Market is poised for further expansion, appealing to a broader audience.

Growing Demand for Wireless Audio Solutions

The Hearables Market is experiencing a notable surge in demand for wireless audio solutions. Consumers increasingly prefer the convenience and freedom offered by wireless technology, which eliminates the hassle of tangled wires. This trend is reflected in the market data, indicating that the wireless segment accounts for over 70% of total hearables sales. As more individuals seek seamless connectivity with their devices, manufacturers are responding by innovating and enhancing their product offerings. The integration of advanced Bluetooth technology and improved battery life further fuels this demand. Consequently, the Hearables Market is likely to witness sustained growth as consumers prioritize mobility and ease of use in their audio experiences.

Increased Focus on Personalization and Customization

Personalization and customization are emerging as key drivers in the Hearables Market. Consumers are increasingly seeking products that cater to their individual preferences, whether in terms of sound profiles, fit, or design. This trend is supported by market data showing that brands offering customizable options are gaining traction among consumers. The ability to tailor audio settings or choose from a variety of designs enhances user satisfaction and loyalty. Furthermore, advancements in technology allow for more sophisticated personalization features, such as adaptive sound control that adjusts audio settings based on the environment. As the demand for personalized experiences grows, the Hearables Market is likely to evolve, with brands focusing on delivering tailored solutions.

Rising Popularity of Fitness and Wellness Applications

The Hearables Market is witnessing a rising popularity of fitness and wellness applications. As health consciousness grows among consumers, hearables that offer fitness tracking and health monitoring features are becoming increasingly sought after. Market data indicates that a significant portion of hearables sales is driven by consumers looking for devices that can assist in their fitness journeys. Features such as heart rate monitoring, step tracking, and integration with health apps are appealing to a wide demographic. This trend suggests that the Hearables Market is not only about audio quality but also about enhancing overall well-being. As more individuals prioritize health, the demand for hearables with fitness capabilities is expected to rise.