Aging Population

The demographic shift towards an aging population is significantly influencing the Healthcare Creditor Insurance Market. As the proportion of elderly individuals increases, there is a corresponding rise in healthcare needs and associated costs. This demographic trend is supported by projections indicating that by 2030, nearly one in five individuals will be of retirement age, leading to a surge in demand for healthcare services. Older adults often face chronic health conditions that require ongoing medical attention, thereby increasing their financial liabilities. Healthcare creditor insurance becomes a crucial tool for this demographic, providing them with the necessary coverage to manage their healthcare expenses. The implications of this trend suggest that the Healthcare Creditor Insurance Market will likely expand to accommodate the unique needs of an aging population, ensuring that they have access to the financial resources required for their healthcare.

Rising Healthcare Costs

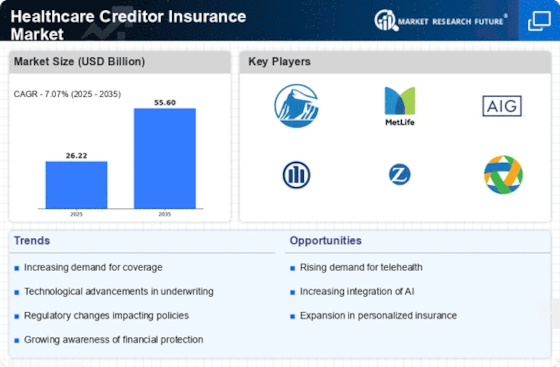

The escalating costs associated with healthcare services are a primary driver for the Healthcare Creditor Insurance Market. As medical expenses continue to rise, individuals and families are increasingly seeking financial protection against unforeseen health-related expenditures. This trend is underscored by data indicating that healthcare spending has consistently outpaced inflation rates, leading to a heightened demand for insurance products that can mitigate financial risks. Consequently, healthcare creditor insurance serves as a safety net, allowing consumers to manage their financial obligations more effectively in the face of rising medical bills. The increasing prevalence of chronic diseases further exacerbates this situation, as ongoing treatment can lead to substantial financial burdens. Thus, the Healthcare Creditor Insurance Market is likely to experience growth as consumers prioritize financial security in their healthcare decisions.

Increased Regulatory Focus

The evolving regulatory landscape is a critical driver for the Healthcare Creditor Insurance Market. Governments and regulatory bodies are increasingly emphasizing consumer protection and transparency in insurance practices. This heightened focus is evident in the implementation of regulations that require insurers to provide clearer information regarding policy terms and coverage options. Such regulations aim to enhance consumer confidence and ensure that individuals are adequately informed when selecting insurance products. Additionally, compliance with these regulations often necessitates changes in insurance offerings, prompting companies to innovate and adapt their products to meet new standards. As a result, the Healthcare Creditor Insurance Market is likely to see a shift towards more consumer-friendly policies, which could enhance market growth and foster greater trust among consumers.

Technological Advancements

Technological advancements are reshaping the landscape of the Healthcare Creditor Insurance Market. Innovations in telemedicine, health monitoring devices, and data analytics are enhancing the efficiency and accessibility of healthcare services. These advancements not only improve patient outcomes but also influence insurance products by enabling more personalized and flexible coverage options. For instance, the integration of artificial intelligence in underwriting processes allows insurers to assess risks more accurately, potentially leading to lower premiums for consumers. Furthermore, the rise of digital health platforms facilitates easier access to healthcare information, empowering consumers to make informed decisions regarding their insurance needs. As technology continues to evolve, the Healthcare Creditor Insurance Market is poised to adapt, offering products that align with the changing dynamics of healthcare delivery and consumer expectations.

Growing Demand for Financial Security

The increasing demand for financial security in the face of unpredictable healthcare expenses is a significant driver for the Healthcare Creditor Insurance Market. Consumers are becoming more aware of the potential financial risks associated with medical emergencies and are actively seeking solutions to safeguard their financial well-being. This trend is reflected in market data indicating a rise in the purchase of insurance products that offer coverage for medical debts and related expenses. As individuals prioritize financial planning and risk management, healthcare creditor insurance emerges as a viable option to alleviate concerns about unexpected healthcare costs. The growing emphasis on financial literacy and planning further supports this trend, suggesting that the Healthcare Creditor Insurance Market will continue to expand as consumers seek to secure their financial futures.