Market Share

Grid Scale Battery Market Share Analysis

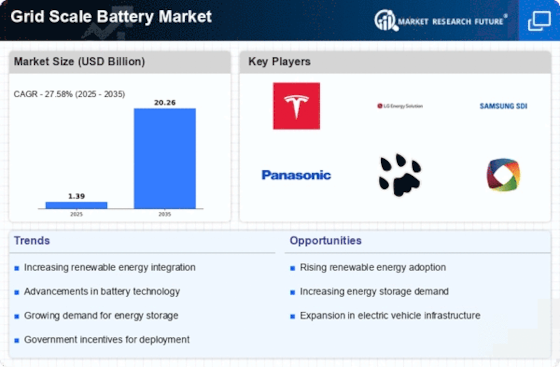

The international Grid-scale battery Market is similarly segmented into three, specifically with the aid of battery type, by means of electricity Generation, and by using utility. Battery types are similarly Sub-segmented as Lithium-ion batteries, waft batteries, Zinc-hybrid batteries, and Sodium-Based Batteries; lithium-ion batteries are leading as those batteries are especially used in UPS, having true efficiency. Power Generation is sub-segmented into Power capability or rating, Energy capability, and Power ability in this phase. Applications are Subdivided into top shaving, load transferring, and renewable sources. Integration: Backup strength is the fastest growing phase, as most companies, in general, rely on battery durability and the amount of strength provided while energy is reduced. The grid-scale battery market has been witnessing good-sized developments in recent years, reflecting the evolving panorama of the power sector. One outstanding trend is the developing demand for strong garage solutions to aid renewable electricity integration into the electricity grid. Advancements in battery technologies were a key motive force of market tendencies within the grid-scale battery sector. Lithium-ion batteries, especially, have won prominence because of their excessive energy density, efficiency, and declining fees. These technological improvements have contributed to an elevated deployment of grid-scale batteries, allowing efficient power storage and control on a massive scale. Moreover, the grid-scale battery market has witnessed a remarkable boom in funding and investment. Governments, utilities, and private buyers apprehend the strategic significance of energy storage in accomplishing power security and grid reliability. Incentive programs and supportive guidelines were applied globally to encourage the adoption of grid-scale battery structures. This inflow of investments has not only improved the deployment of existing technologies but has also spurred innovation, fostering the improvement of recent and progressed battery technology. Environmental sustainability has turned out to be a key attention in the grid-scale battery market. Stakeholders are increasingly emphasizing the significance of developing and adopting eco-friendly power storage solutions. Recycling and accountable disposal of batteries are gaining attention to limit environmental effects and ensure the sustainability of the entire energy garage value chain. In the end, the grid-scale battery market presents process dynamic changes pushed via technological advancements, extended investments, digitalization, scalability, and a growing emphasis on environmental sustainability. These tendencies collectively contribute to the maturation of the grid-scale battery zone, positioning it as a critical element in the global strength transition toward a greater sustainable and resilient destiny.

Leave a Comment