Top Industry Leaders in the Grid Scale Battery Market

*Disclaimer: List of key companies in no particular order

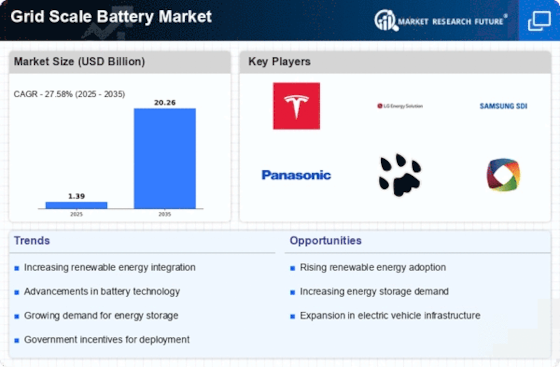

The global market for grid-scale batteries is undergoing remarkable growth, driven by the increasing embrace of renewable energy and a pressing need for grid stability. This burgeoning sector is crowded with both established industry leaders and innovative startups, all competing for prominence. A comprehensive understanding of the competitive landscape, strategies employed by key players, and emerging trends is essential for navigating this dynamic environment.

Prominent Players and Established Approaches: Leading the market are major players such as Samsung SDI CO., LTD. (South Korea), NGK Insulators, LTD. (Japan), BYD Company Ltd (China), General Electric (U.S.), Redflow Limited (Australia), Ambri Incorporated (U.S.), VRB Energy (Canada), 24M Technologies, Inc. (U.S.), Lockheed Martin Corporation (U.S.), FZSONICK SA (Switzerland), KORE Power, Inc. (U.S.), and others. Established giants like LG Chem, Samsung, Panasonic, Tesla, and BYD leverage their manufacturing capabilities, brand recognition, and extensive supply chains to secure significant market shares. For example, LG Chem has the highest production capacity and caters to diverse applications, while Tesla's Powerwall system enjoys widespread consumer appeal. These companies focus on continuous technological advancements, expanding their geographic reach, and forming strategic partnerships with utilities and renewable developers.

Factors Influencing Market Share: Beyond brand prominence, various factors determine market share in this highly competitive arena. Cost-competitiveness is crucial, with companies like Fluence and Sonnen aggressively pursuing innovative production processes and modular battery designs. Geographical considerations also play a role, with regional players like CATL in China and GS Yuasa in Japan establishing significant niches. Moreover, vertical integration across the entire value chain, from raw materials to system integration, is increasingly becoming a key differentiator.

Emerging Trends and Disruptive Entrants: The market is witnessing the emergence of new trends. For instance, Redflow's zinc-bromide flow batteries cater to niche applications like microgrids, offering long discharge durations and safety advantages. Sodium-ion batteries, advocated by companies like HiNa Battery Technology, promise lower costs and reduced reliance on lithium resources. Startups such as Stem and AES are at the forefront of developing grid-scale battery management systems and software solutions, adding substantial value to the overall market.

Competitive Landscape and Future Prospects: The competitive scenario is marked by intense rivalry, technological innovation, and strategic alliances. Traditional players face challenges from agile startups providing niche solutions and cost-effective alternatives. Collaborations, such as Tesla partnering with utilities for large-scale deployments, are becoming more common. Anticipated mergers and acquisitions are expected to reshape the market as companies seek to consolidate their positions and access new technologies.

Looking ahead, the grid-scale battery market is poised for sustained growth, driven by factors like ambitious renewable energy targets, increasing grid modernization efforts, and advancements in battery technology. Companies prioritizing cost reduction, geographical expansion, diversification, and strategic partnerships are best positioned to seize this significant opportunity. The market is anticipated to remain dynamic, with disruptive technologies and innovative business models constantly emerging, ensuring an exciting competition for market dominance in the years to come.

In conclusion, the grid-scale battery market is a battleground for established players and emerging disruptors. A thorough understanding of key players, drivers of market share, and emerging trends is essential for navigating this complex yet promising market. Those who adapt to the changing landscape and embrace innovation will shape the future of energy storage and grid resilience.

Industry Developments and Recent Updates: Samsung SDI (South Korea): • Nov 07, 2023: Unveiled its Gen 5 battery technology with improved energy density and faster charging. (Source: Samsung SDI website) NGK Insulators (Japan): • Oct 26, 2023: Successfully completed a 1MWh grid-scale battery demonstration project in Hawaii. (Source: NGK Insulators website) BYD Company Ltd (China): • Nov 28, 2023: Launched its Blade Battery technology for grid-scale energy storage applications. (Source: BYD website) General Electric (U.S.): • Oct 17, 2023: Launched its GridLM platform for managing and optimizing grid-scale battery systems. (Source: GE Renewable Energy website)