Market Analysis

In-depth Analysis of Grid Scale Battery Market Industry Landscape

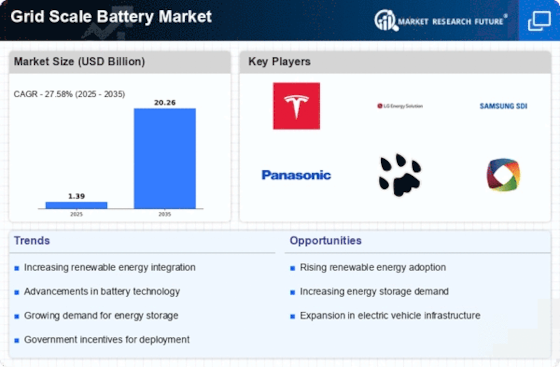

Economic factors also contribute to the dynamics of the grid-scale battery market. The lowering prices of battery technologies, pushed by way of economies of scale, production performance, and improved opposition, make those answers more reachable to a wider variety of clients. As the price per kilowatt-hour keeps saying no, the economic feasibility of grid-scale batteries improves, making them an appealing option for utilities, corporations, and grid operators. In conclusion, the grid-scale battery market is trending with the aid of a complex interplay of factors, together with the worldwide shift towards sustainable energy, technological improvements, authorities' policies, financial concerns, the evolving energy panorama, market opposition, and public focus. The convergence of those elements defines the present and destiny panorama of grid-scale battery answers, positioning them as a crucial enabler of an extra resilient, sustainable, and reliable electricity infrastructure. The essential drivers of this worldwide grid-scale battery market are the development of the era and growing demand for power-efficient machinery; power garages can provide a range of applications, therefore beginning up markets for power garages. Low strength and energy density are the principal tasks in the grid-scale battery Market. The grid-scale battery market is prompted by a myriad of factors that collectively form its dynamics and boom trajectory. One important determinant is the growing demand for dependable and sustainable strength answers. As societies worldwide attempt to lessen their carbon footprint and transition towards purifier-strength assets, the need for large-scale electricity storage becomes vital. Technological improvements additionally stand as a key market aspect. Continued research and improvement in battery technology will contribute to the improvement of strong garage structures, making them more green, value-effective, and durable. Government policies and regulations play a big function in shaping the grid-scale battery market. Subsidies, incentives, and supportive regulatory frameworks can boost the adoption of strength garage solutions, making them more economically possible for investors and corporations. Governments worldwide are spotting the significance of strength garages in achieving their renewable strength dreams and are enforcing rules that inspire the improvement and deployment of grid-scale battery structures. Economic factors also contribute to the dynamics of the grid-scale battery market. The lowering costs of battery technologies, pushed by way of economies of scale, production performance, and improved competition, make these solutions more handy to a broader variety of customers. As the price consistent with kilowatt-hour keeps declining, the monetary feasibility of grid-scale batteries improves, making them an attractive alternative for utilities, groups, and grid operators. In the end, the grid-scale battery market is formed by means of a complicated interplay of factors, consisting of the worldwide shift towards sustainable energy, technological advancements, government guidelines, monetary considerations, the evolving electricity landscape, market opposition, and public awareness. The convergence of these elements defines the prevailing and future landscape of grid-scale battery solutions, positioning them as an important enabler of a more resilient, sustainable, and dependable electricity infrastructure.

Leave a Comment