Environmental Regulations

The Global Green Coating Market Industry is experiencing a surge in demand due to stringent environmental regulations imposed by governments worldwide. These regulations aim to reduce volatile organic compounds and promote eco-friendly materials in manufacturing processes. For instance, the European Union has implemented directives that mandate lower emissions from coatings, driving manufacturers to innovate and adopt green technologies. As a result, the market is projected to reach 103.0 USD Billion in 2024, reflecting a growing commitment to sustainability in various sectors, including automotive and construction.

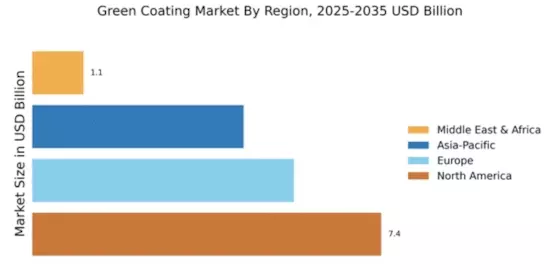

Market Growth Projections

The Global Green Coating Market Industry is poised for remarkable growth, with projections indicating a market size of 242.7 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate of 8.1% from 2025 to 2035, reflecting the increasing adoption of sustainable practices across various sectors. The demand for eco-friendly coatings is expected to rise as industries seek to comply with stringent regulations and meet consumer preferences for environmentally responsible products. This upward trend underscores the industry's potential to significantly impact global sustainability efforts.

Rising Consumer Awareness

Consumer awareness regarding environmental sustainability is a pivotal driver for the Global Green Coating Market Industry. As individuals become more conscious of their ecological footprint, they increasingly prefer products that are environmentally friendly. This shift in consumer behavior has prompted manufacturers to develop and market green coatings that align with these values. For example, brands in the furniture and automotive industries are now highlighting their use of low-emission coatings. This trend is expected to contribute to a compound annual growth rate of 8.1% from 2025 to 2035, indicating a robust future for eco-conscious products.

Technological Advancements

Technological advancements play a crucial role in the evolution of the Global Green Coating Market Industry. Innovations in formulation and application techniques have led to the development of high-performance coatings that meet environmental standards without compromising quality. For instance, waterborne and powder coatings have gained popularity due to their lower environmental impact. These advancements not only enhance product performance but also expand the market reach into various applications, including industrial and decorative coatings. As a result, the market is anticipated to grow significantly, potentially reaching 242.7 USD Billion by 2035.

Growth in End-Use Industries

The expansion of end-use industries such as automotive, construction, and electronics is a significant driver for the Global Green Coating Market Industry. As these sectors increasingly adopt sustainable practices, the demand for eco-friendly coatings rises correspondingly. For example, the automotive industry is shifting towards electric vehicles, which often utilize green coatings to enhance aesthetic appeal while adhering to environmental regulations. This trend is likely to bolster market growth, as companies seek to differentiate themselves through sustainable offerings, further solidifying the industry's trajectory towards a greener future.

Government Initiatives and Incentives

Government initiatives and incentives aimed at promoting sustainable practices are instrumental in shaping the Global Green Coating Market Industry. Various countries are introducing financial incentives for manufacturers who adopt eco-friendly technologies and materials. For instance, tax breaks and subsidies for companies that invest in green coating technologies encourage innovation and adoption. These initiatives not only support the growth of the market but also align with global sustainability goals. As a result, the industry is poised for substantial growth, with projections indicating a market size of 103.0 USD Billion in 2024.