Consumer Awareness

Consumer awareness regarding environmental issues is significantly influencing the Green and Bio-Based Solvents Market. As individuals become more informed about the detrimental effects of traditional solvents on health and the environment, there is a marked shift towards products that are perceived as safer and more sustainable. This heightened awareness is driving demand for bio-based solvents across various sectors, including paints, coatings, and cleaning products. Market Research Future indicates that consumers are willing to pay a premium for eco-friendly products, which is likely to encourage manufacturers to invest in the development of green solvents. Consequently, this trend is expected to bolster the growth of the Green and Bio-Based Solvents Market.

Regulatory Frameworks

Regulatory frameworks play a crucial role in shaping the Green and Bio-Based Solvents Market. Governments worldwide are implementing stringent regulations aimed at reducing volatile organic compounds (VOCs) and promoting the use of safer, bio-based alternatives. For instance, the European Union's REACH regulation mandates the registration and evaluation of chemical substances, which encourages manufacturers to transition to greener solvents. This regulatory push is expected to drive the market, as companies seek compliance while also capitalizing on the growing demand for sustainable products. The anticipated increase in regulatory measures is likely to further stimulate innovation within the Green and Bio-Based Solvents Market.

Market Diversification

Market diversification is a key driver for the Green and Bio-Based Solvents Market. As industries seek to reduce their reliance on conventional solvents, there is a growing exploration of various bio-based sources, including agricultural by-products and renewable resources. This diversification not only enhances the availability of green solvents but also fosters competition among manufacturers, leading to improved product offerings. The expansion of applications for bio-based solvents, ranging from industrial cleaning to personal care products, is indicative of this trend. The increasing variety of options available in the market is likely to attract a broader customer base, thereby stimulating growth within the Green and Bio-Based Solvents Market.

Technological Innovations

Technological innovations are emerging as a significant driver for the Green and Bio-Based Solvents Market. Advances in extraction and production technologies are enabling the development of more efficient and cost-effective bio-based solvents. Innovations such as enzymatic processes and biotechnological methods are enhancing the yield and purity of these solvents, making them more competitive with traditional petroleum-based options. As a result, the market is witnessing an influx of new products that meet the growing demand for sustainable solutions. The ongoing research and development efforts in this area are likely to further propel the Green and Bio-Based Solvents Market, as companies strive to offer innovative and environmentally friendly alternatives.

Sustainability Initiatives

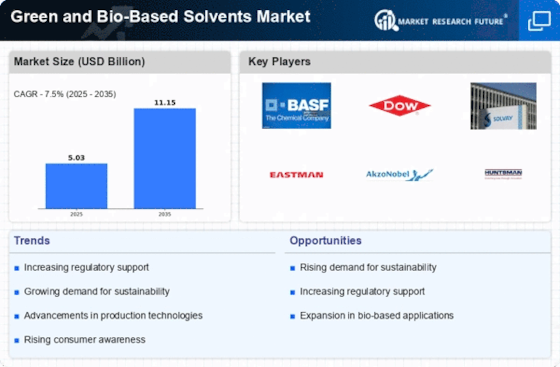

The increasing emphasis on sustainability initiatives is a pivotal driver for the Green and Bio-Based Solvents Market. Companies are increasingly adopting eco-friendly practices to align with consumer preferences and regulatory requirements. This shift is evidenced by a growing number of organizations committing to reduce their carbon footprints and enhance their sustainability profiles. The market for green solvents is projected to reach approximately USD 8 billion by 2027, reflecting a compound annual growth rate of around 5.5%. This trend indicates a robust demand for bio-based alternatives that minimize environmental impact, thereby propelling the growth of the Green and Bio-Based Solvents Market.