Top Industry Leaders in the Green and Bio-Based Solvents Market

Green and bio-based solvents are revolutionizing the chemical landscape, offering a sustainable alternative to traditional petrochemical-derived solvents. This burgeoning market is attracting a swarm of players vying for a slice of the pie. Let's delve into the competitive strategies, key factors influencing market share, and the latest developments shaping this exciting industry.

Strategies adopted by leading players:

- Product diversification: Companies are expanding their portfolios beyond basic bio-alcohols to include complex esters, lactates, and glycol ethers, catering to diverse application needs. BASF, for instance, boasts a wide range of bio-based solvents like Cellulon and Terrasol.

- Vertical integration: Some players, like Archer Daniels Midland (ADM), are integrating upstream, securing sustainable feedstock sources like corn stover for bio-solvent production. This ensures supply chain control and cost competitiveness.

- Partnerships and acquisitions: Collaboration is key, with established players partnering with startups and universities to accelerate research and development. Dow Chemical's strategic alliance with Novozymes exemplifies this, aiming to develop next-generation bio-based solvents.

- Sustainability focus: Green credentials are crucial. Companies are highlighting their commitment to renewable feedstocks, carbon footprint reduction, and closed-loop recycling of bio-solvents to attract environmentally conscious customers.

- Regional expansion: Emerging markets like Asia-Pacific are witnessing robust growth in green solvent demand. Companies are setting up production facilities and distribution networks in these regions to capitalize on the opportunity.

Factors influencing market share:

- Product performance: Bio-based solvents need to match the performance of traditional solvents in terms of solvency power, evaporation rate, and compatibility with different materials. Companies are constantly improving their formulations to bridge this gap.

- Cost competitiveness: While bio-based solvents offer long-term environmental benefits, their upfront cost can be higher than traditional solvents. Governments can play a role by offering subsidies and tax breaks to incentivize their adoption.

- Regulatory landscape: Stringent environmental regulations on VOC emissions and waste disposal are driving demand for green solvents. Companies need to ensure their products comply with these regulations to gain market access.

- Consumer awareness: Public awareness of the environmental benefits of green solvents is crucial for driving adoption. Educational campaigns and eco-labeling initiatives can play a significant role in promoting this awareness.

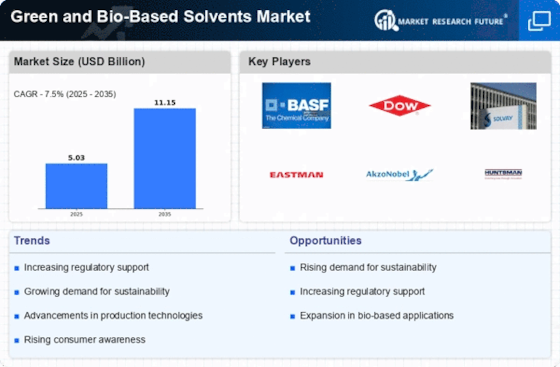

List of Key Players in the Green and bio-based Solvents Market

- Solvay (Belgium)

- Archer Daniels Midland Company (US)

- BASF SE (Germany)

- DowDuPont (US)

- Vertec BioSolvents (US)

- CREMER OLEO GmbH & Co. KG (Germany)

- Cargill, Incorporated (US)

- Corbion (The Netherlands)

- Merck KGaA (Germany)

- LyondellBasell Industries Holdings B.V. (US)

- Galactic (Belgium)

- Arkema Group (France).

Recent developments:

October 2023: Corbion launches NovaSol E 100, a bio-based ester solvent targeted at the cosmetics and personal care industry due to its mild nature and excellent skin compatibility.

November 2023: Myriant Corporation enters into a strategic partnership with a Chinese company to manufacture and distribute its bio-based succinic acid, a key building block for various green solvents.

December 2023: The American Coatings Association releases a report highlighting the increasing preference for bio-based solvents in the paint and coatings industry due to their performance and sustainability benefits.