North America : Innovation and Sustainability Focus

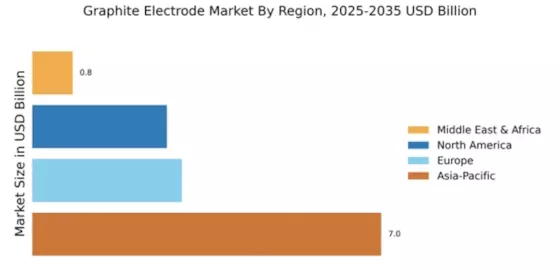

The North American graphite electrode market is projected to reach $2.7 billion by 2025, driven by increasing demand from the steel and aluminum industries. Regulatory support for sustainable manufacturing practices is also a key growth driver, as companies seek to reduce their carbon footprint. The region's focus on innovation in electrode technology further enhances market potential, with a shift towards high-performance products that meet stringent environmental standards. Leading countries in this region include the US and Canada, where major players like GrafTech International Holdings Inc. are actively expanding their production capabilities. The competitive landscape is characterized by a mix of established firms and emerging players, all vying for market share. The presence of advanced manufacturing facilities and R&D centers in North America positions the region as a hub for graphite electrode innovation.

Europe : Strong Manufacturing Base

Europe's graphite electrode market is expected to grow to $3.0 billion by 2025, fueled by a strong manufacturing base and increasing demand from the automotive and aerospace sectors. Regulatory frameworks promoting energy efficiency and emissions reduction are significant catalysts for market growth. The region's commitment to sustainability and innovation in production processes is driving the adoption of advanced graphite electrode technologies. Germany, France, and Italy are the leading countries in this market, with key players like SGL Carbon SE and Mitsubishi Chemical Corporation establishing a strong foothold. The competitive landscape is marked by strategic partnerships and collaborations aimed at enhancing product offerings. The presence of a well-established supply chain and skilled workforce further strengthens Europe's position in The Graphite Electrode.

Asia-Pacific : Emerging Powerhouse in Production

The Asia-Pacific region dominates the graphite electrode market, with a projected size of $7.0 billion by 2025. This growth is driven by rapid industrialization, particularly in countries like China and India, where demand for steel and aluminum is surging. Regulatory initiatives aimed at enhancing production efficiency and reducing environmental impact are also pivotal in shaping market dynamics. The region's focus on technological advancements in electrode manufacturing is expected to further boost growth. China is the largest market, with significant contributions from companies like Fangda Carbon New Material Co., Ltd. and Tokai Carbon Co., Ltd. The competitive landscape is characterized by a mix of domestic and international players, all striving to capture market share. The presence of a robust supply chain and increasing investments in R&D are key factors that enhance the region's competitive edge in The Graphite Electrode.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) graphite electrode market is projected to reach $0.81 billion by 2025, driven by increasing industrial activities and infrastructure development. The region's focus on diversifying its economy away from oil dependency is fostering growth in manufacturing sectors, including steel production. Regulatory support for sustainable practices is also emerging, encouraging investments in advanced electrode technologies. Countries like South Africa and the UAE are leading the charge in this market, with a growing number of local and international players entering the scene. The competitive landscape is evolving, with companies seeking to establish a foothold in this emerging market. The presence of abundant natural resources and a young workforce presents significant opportunities for growth in the graphite electrode sector.