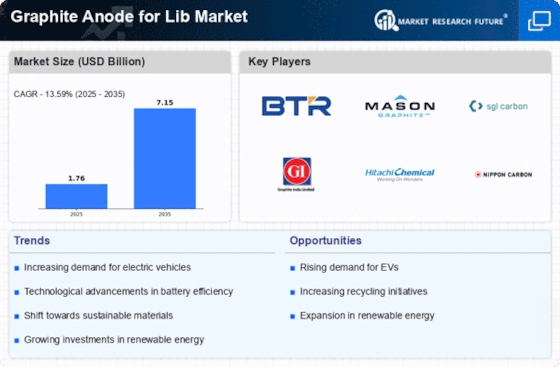

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a primary driver for the Graphite Anode for Lib Market. As consumers and manufacturers prioritize sustainable transportation solutions, the demand for high-performance batteries has surged. In 2025, the EV market was projected to grow at a compound annual growth rate (CAGR) of over 20%, leading to a corresponding rise in the need for graphite anodes. These anodes are essential for enhancing battery efficiency and longevity, making them a critical component in the production of EV batteries. Consequently, the Graphite Anode for Lib Market is likely to experience substantial growth as automakers ramp up production to meet consumer demand.

Expansion of Energy Storage Solutions

The expansion of energy storage solutions is emerging as a significant driver for the Graphite Anode for Lib Market. As the need for efficient energy storage systems grows, particularly in conjunction with renewable energy sources, the demand for lithium-ion batteries is expected to rise. These batteries, which utilize graphite anodes, are essential for storing energy generated from solar and wind sources. In 2025, the energy storage market was anticipated to reach a valuation of several billion dollars, indicating a robust growth trajectory. This trend suggests that the Graphite Anode for Lib Market will likely experience increased demand as energy storage solutions become more prevalent.

Growing Consumer Awareness of Sustainability

The rising consumer awareness regarding sustainability and environmental impact is driving the Graphite Anode for Lib Market. As individuals become more conscious of their carbon footprints, there is a marked shift towards electric vehicles and renewable energy solutions. This trend is likely to increase the demand for lithium-ion batteries, which are integral to these technologies. In 2025, surveys indicated that over 70% of consumers preferred sustainable products, suggesting a strong market potential for graphite anodes. Consequently, manufacturers in the Graphite Anode for Lib Market are expected to align their production strategies with these consumer preferences, enhancing their market position.

Government Policies Supporting Renewable Energy

Government initiatives aimed at promoting renewable energy sources are playing a pivotal role in shaping the Graphite Anode for Lib Market. Policies that incentivize the use of electric vehicles and renewable energy storage solutions are likely to increase the demand for lithium-ion batteries, which rely heavily on graphite anodes. For example, various countries have implemented tax credits and subsidies for EV purchases, which could lead to a significant uptick in battery production. As a result, the Graphite Anode for Lib Market is expected to benefit from these supportive regulatory frameworks, fostering an environment conducive to growth and innovation.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are significantly influencing the Graphite Anode for Lib Market. Innovations such as improved anode design and enhanced material properties are enabling manufacturers to produce batteries with higher energy densities and faster charging capabilities. For instance, the introduction of silicon-graphite composite anodes has shown promise in increasing battery performance. As these technologies evolve, they are expected to drive the demand for high-quality graphite anodes, thereby propelling the Graphite Anode for Lib Market forward. The integration of advanced manufacturing techniques may also lead to cost reductions, further stimulating market growth.