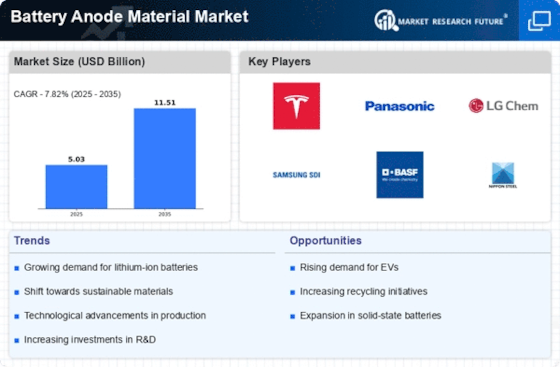

Advancements in Battery Technology

Technological advancements in battery technology are reshaping the Battery Anode Material Market. Innovations such as solid-state batteries and silicon-based anodes are gaining traction, offering improved performance metrics compared to traditional graphite anodes. For instance, silicon anodes can potentially increase energy capacity by up to 300%, which is a substantial improvement. As research and development efforts continue to evolve, the demand for high-quality anode materials that can support these advancements is likely to rise. This trend indicates a robust growth trajectory for the Battery Anode Material Market, as manufacturers seek to meet the needs of next-generation battery applications.

Rising Consumer Electronics Market

The burgeoning consumer electronics market is a significant driver of the Battery Anode Material Market. With the proliferation of smartphones, laptops, and other portable devices, the demand for high-capacity batteries is escalating. In 2025, the consumer electronics sector is projected to generate substantial revenue, further fueling the need for advanced battery technologies. Manufacturers are increasingly seeking innovative anode materials that can provide longer battery life and faster charging capabilities. This trend indicates a strong correlation between the growth of consumer electronics and the Battery Anode Material Market, as both sectors evolve to meet consumer expectations for performance and efficiency.

Growing Energy Storage Applications

The increasing need for energy storage solutions is another critical driver of the Battery Anode Material Market. As renewable energy sources like solar and wind become more prevalent, the demand for efficient energy storage systems is surging. Battery systems that utilize advanced anode materials are essential for storing energy generated from these intermittent sources. In 2025, the energy storage market is expected to reach a valuation of over 200 billion, highlighting the potential for growth in the Battery Anode Material Market. This trend suggests that manufacturers will need to focus on developing anode materials that can enhance the performance and longevity of energy storage systems.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting clean energy solutions are significantly influencing the Battery Anode Material Market. Many countries are implementing stringent emissions standards and providing financial incentives for the adoption of electric vehicles and renewable energy technologies. For example, tax credits and subsidies for EV purchases are becoming commonplace, which in turn drives the demand for efficient battery systems. This regulatory environment encourages manufacturers to invest in advanced battery anode materials that comply with new standards, thereby fostering growth within the Battery Anode Material Market. The alignment of policy frameworks with market needs is likely to enhance the industry's expansion.

Increasing Demand for Electric Vehicles

The rising demand for electric vehicles (EVs) is a primary driver of the Battery Anode Material Market. As consumers and manufacturers alike prioritize sustainability and reduced carbon footprints, the shift towards EVs accelerates. In 2025, the EV market is projected to grow significantly, with estimates suggesting that over 30 million units will be sold worldwide. This surge in EV production necessitates advanced battery technologies, particularly those utilizing high-performance anode materials. Consequently, manufacturers are increasingly investing in innovative battery anode materials to enhance energy density and charging speeds, thereby propelling the Battery Anode Material Market forward.