Emphasis on STEM Education

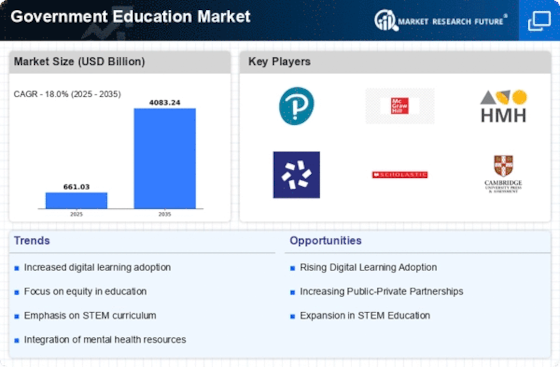

The Government Education Market is witnessing a pronounced emphasis on STEM (Science, Technology, Engineering, and Mathematics) education. This focus is largely a response to the increasing demand for skilled professionals in these fields, which are critical for economic development and innovation. Recent statistics indicate that job openings in STEM-related occupations are projected to grow by 10% over the next decade, significantly outpacing other sectors. In response, governments are implementing initiatives to enhance STEM curricula in schools, providing resources and training for educators. This strategic emphasis on STEM education is likely to cultivate a workforce equipped with the necessary skills to thrive in a technology-driven economy. As a result, the Government Education Market is expected to expand, driven by investments in STEM programs and partnerships with industry stakeholders.

Globalization of Education

The Government Education Market is increasingly influenced by the globalization of education, which facilitates cross-border collaboration and knowledge exchange. As educational institutions seek to prepare students for a globalized workforce, there is a growing emphasis on international partnerships and exchange programs. Data indicates that participation in international education programs has risen by 15% in recent years, reflecting a shift towards a more interconnected educational landscape. Governments are recognizing the importance of equipping students with global competencies, leading to the development of curricula that emphasize cultural awareness and language skills. This trend is likely to continue, as the demand for globally-minded graduates increases. As a result, the Government Education Market is expected to expand, driven by initiatives that promote international collaboration and enhance the educational experience for students.

Technological Advancements

Technological advancements are profoundly influencing the Government Education Market, as educational institutions increasingly adopt digital tools and platforms. The integration of technology in classrooms is not merely a trend; it is becoming a necessity for effective teaching and learning. Data suggests that over 70% of schools are now utilizing some form of digital learning resources, which enhances student engagement and facilitates personalized learning experiences. Furthermore, the rise of online learning platforms has expanded access to education, particularly in remote areas. This shift towards technology-driven education is likely to continue, as governments recognize the potential of digital solutions to improve educational outcomes. Consequently, the Government Education Market is expected to evolve, with a focus on developing and implementing innovative educational technologies that cater to diverse learning needs.

Increased Government Funding

The Government Education Market is experiencing a notable increase in funding allocations from various governmental bodies. This trend appears to be driven by a growing recognition of the importance of education in fostering economic growth and social stability. Recent data indicates that education budgets have seen an average annual increase of 5% over the past few years, reflecting a commitment to enhancing educational infrastructure and resources. Such funding is likely to facilitate the development of new programs, improve teacher training, and expand access to educational materials. As governments prioritize education, the market is poised for growth, with investments directed towards innovative teaching methods and technology integration. This influx of resources may also lead to improved educational outcomes, thereby reinforcing the significance of the Government Education Market in shaping future generations.

Focus on Mental Health and Wellbeing

The Government Education Market is increasingly prioritizing mental health and wellbeing within educational settings. Recognizing the impact of mental health on student performance and overall educational outcomes, governments are implementing policies aimed at supporting mental health initiatives in schools. Recent surveys indicate that nearly 40% of students report experiencing significant stress, highlighting the need for comprehensive mental health programs. As a response, educational institutions are integrating mental health resources, counseling services, and wellness programs into their curricula. This focus on mental health is likely to foster a more supportive learning environment, ultimately enhancing student engagement and retention. Consequently, the Government Education Market is evolving to include mental health as a critical component of educational success, reflecting a holistic approach to student development.