Top Industry Leaders in the Golf Cart Battery Market

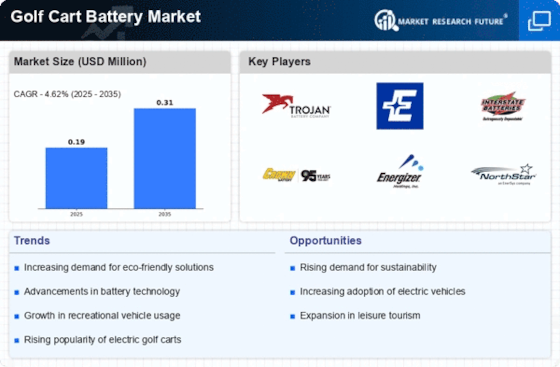

The golf cart battery sector, though appearing to be a niche market, is gearing up for a steady ascent, propelled by an increase in golf cart adoption, sustainability trends, and technological advancements. In this flourishing landscape, a competitive struggle is unfolding, with both established players and new entrants contending for a leading position.

Established players such as Crown Battery, East Penn Manufacturing, Exide Technologies, and EnerSys have traditionally thrived in this market. Their strategies encompass a combination of product diversification, regional expansion, and technological innovation. They offer both traditional lead-acid and modern lithium-ion batteries, catering to diverse budget and performance preferences. Moreover, these companies are capitalizing on the growing demand in Asia-Pacific, particularly in China, where golf cart popularity is on the rise. Additionally, their focus on investing in research and development for next-generation batteries with extended range, faster charging, and enhanced safety features contributes to their competitive edge.

On the other hand, emerging players like Samsung SDI and Leoch International Technology Ltd. are injecting fresh energy into the market. Their emphasis is on leveraging the inherent advantages of lithium-ion batteries, such as lightweight design, longer lifespan, and environmental friendliness. These newcomers are also adopting direct-to-consumer sales strategies, bypassing traditional distribution channels to provide competitive pricing and personalized customer service. Additionally, they are actively engaging in sustainability initiatives by partnering with recycling programs and developing eco-friendly manufacturing processes.

To assess market share in this dynamic scenario, a multifaceted approach is required, considering factors like the technology mix, regional variations, and the growing importance of sustainability. The dominance of lead-acid batteries is gradually being challenged by the rise of lithium-ion batteries, influenced by factors such as affordability and the availability of charging infrastructure. Regional growth patterns vary, with North America remaining a significant market due to its established golf culture, while the Asia-Pacific region experiences a surge in demand driven by rising disposable incomes and infrastructure development. Environmental concerns are also becoming crucial, influencing consumer choices towards eco-friendly manufacturing practices and responsible battery disposal.

New trends are further shaping the competitive landscape, including the integration of smart batteries with IoT technology for real-time monitoring, subscription models offering batteries "as a service," and second-life initiatives repurposing used batteries for non-critical applications to promote sustainability and reduce waste.

The overall competitive scenario in the golf cart battery market resembles a balanced matchplay. Established players leverage their experience and brand recognition, while nimble new entrants bring innovation and agility. Only those who consistently improve their performance, both on and off the course, will secure their place on the leaderboard.

Recent industry developments and updates from key players further illustrate the ongoing dynamics in the golf cart battery market:

C & D Technologies, Inc. announced a strategic partnership with Motive Power Systems (MPS) to offer lithium-ion golf cart battery solutions alongside their existing lead-acid options.

Clarios unveiled plans to invest $1 billion in lithium-ion battery production by 2025, targeting various applications, including golf carts.

Exide Industries Ltd. reported strong growth in their Golf Cart & Power Sports segment, driven by increased demand for both lead-acid and lithium-ion batteries.

GS Yuasa International Ltd. launched their YTXL Series of deep-cycle AGM batteries specifically designed for high-performance golf carts.

Samsung SDI Co., Ltd. showcased their lithium-ion pouch battery solutions for golf carts at the International Battery Expo.

Duracell Inc partnered with Club Car, a leading golf cart manufacturer, to offer co-branded lithium-ion golf cart batteries.

The top companies in the golf cart battery industry include C & D Technologies, Inc., Clarios, Exide Industries Ltd., GS Yuasa International Ltd., Samsung SDI Co., Ltd., Duracell Inc, Leoch International Technology Limited, Interstate Batteries, Crown Battery, RELiON Batteries, East Penn Manufacturing Company, and others.