Regulatory Support for Electric Vehicles

The Golf Cart Battery Market is likely to benefit from increasing regulatory support for electric vehicles, including golf carts. Governments are implementing policies and incentives aimed at promoting the use of electric transportation to reduce carbon emissions. This regulatory environment encourages golf course operators and recreational facilities to transition from gas-powered to electric golf carts, thereby driving demand for electric batteries. As a result, the Golf Cart Battery Market may experience a surge in growth as manufacturers respond to this shift by developing more efficient and sustainable battery options. The alignment of regulatory frameworks with market needs could potentially create a favorable landscape for innovation and investment in the industry.

Growing Popularity of Electric Golf Carts

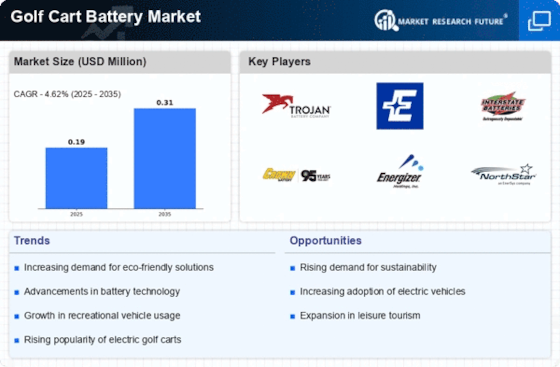

The Golf Cart Battery Market is significantly influenced by the growing popularity of electric golf carts. As more golf courses and recreational facilities adopt electric models for their environmental benefits and operational efficiency, the demand for high-performance batteries is likely to increase. Recent data indicates that electric golf carts account for a substantial portion of the market, with projections suggesting a continued upward trend. This shift not only reflects changing consumer preferences but also aligns with broader sustainability goals. Consequently, manufacturers in the Golf Cart Battery Market are compelled to innovate and produce batteries that meet the specific needs of electric golf carts, thereby driving market growth.

Technological Advancements in Battery Design

The Golf Cart Battery Market is experiencing a notable transformation due to rapid technological advancements in battery design. Innovations such as improved energy density and enhanced charging capabilities are becoming increasingly prevalent. For instance, lithium-ion batteries, which are lighter and more efficient than traditional lead-acid batteries, are gaining traction among manufacturers. This shift is likely to enhance the performance and longevity of golf cart batteries, thereby attracting more consumers. Furthermore, the integration of smart technology, such as battery management systems, is expected to optimize battery usage and extend lifespan. As a result, the Golf Cart Battery Market may witness a surge in demand for these advanced battery solutions, potentially leading to a more competitive landscape.

Increased Investment in Recreational Activities

The Golf Cart Battery Market is poised for growth due to increased investment in recreational activities, particularly in the golf sector. As more individuals seek leisure and outdoor experiences, the demand for golf carts, and consequently, golf cart batteries, is expected to rise. Recent statistics indicate a steady increase in golf course development and renovation projects, which often include the acquisition of new electric golf carts. This trend suggests that the Golf Cart Battery Market will benefit from heightened demand for reliable and efficient battery solutions. Additionally, as golf becomes more accessible to a broader audience, the market for golf cart batteries may expand, presenting new opportunities for manufacturers.

Rising Awareness of Environmental Sustainability

The Golf Cart Battery Market is increasingly shaped by rising awareness of environmental sustainability among consumers and businesses alike. As the focus on eco-friendly practices intensifies, golf courses and recreational facilities are more inclined to adopt electric golf carts, which require efficient battery solutions. This trend is supported by a growing consumer preference for products that minimize environmental impact. Recent surveys indicate that a significant percentage of golf course operators are prioritizing sustainability in their operations, which includes investing in electric golf carts and the associated batteries. Consequently, the Golf Cart Battery Market is likely to see a shift towards more sustainable battery technologies, fostering innovation and growth in this sector.