Glycol Size

Glycol Market Growth Projections and Opportunities

The glycol market is governed by several market factors that together define the industry’s dynamics. The first one is a global demand for glycols which results from their wide application in numerous industries. Automotive, textile, pharmaceutical as well as food and beverage processing are among the key applications of ethylene glycol and propylene glycol which are two major kinds of glycols. Since these industries face demand changes, so does the glycol market. So, for example any growth or shrinkage in the automotive sector affects directly the demand for coolants and antifreeze that employ ethylene glycol.

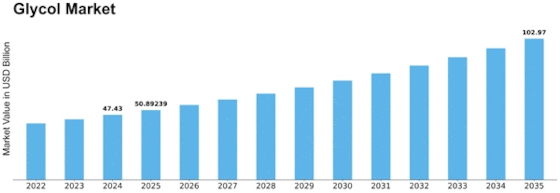

In 2022, Glycol Market Size was valued at USD 41.2 Billion. It is estimated that by 2032, Glycol market industry would be worth more than USD 77.6 billion with a CAGR of 7.30% from its current value of around $44.2 billion.

In addition to this, the price of raw materials has profound implications on the price of Glycols too. Petrochemical feedstocks supply ethylene and propylene plus other derivatives which are the main raw materials for production processes involving glycols. This results in fluctuation in oil and gas prices which determine how much producers will spend on their inputs hence affecting in turn what they charge for gycols they produce . Raw material costs can be affected by natural disasters like earthquakes , fire outbreaks , hurricanes among others ,global geopolitical events like war between countries or different regions leading to destruction of infrastructure ,supply chain disruptions due to issues like riots or strikes such as when there was civil unrest leading to closure some oil plants hence shortage petroleum products especially fuels thus affecting production process adversely . Furthermore shifts in energy policies can also impact greatly on this cost structure through causing an increase in crude oil prices particularly if these measures were implemented when world was still recovering from financial crisis .

This paper demonstrates that Environmental Regulations shape the distribution of glycols. The demand for environmentally friendly substitutes is propelled by increased environmental sustainability and stricter requirements on emissions. Consequently, there has been growing interest in bio-based glycols that are derived from renewable resources. In addition, the regulatory landscape also affects how manufacturers operate their businesses because they have to comply with evolving environmental standards. As governments across the globe strive to reduce carbon footprints, the glycol market moves towards more sustainable solutions.

Another important factor for the Glycols market is Technological Advancement .Continuous research and development efforts are being made in the production processes of glycols resulting in their improved efficiency and low cost manufacturing . Similarly growth of this market space occurs when new types high performance formulations or alternative uses emerge due to modernized technologies like nanotechnology for instance causing some innovative ways producing higher quality products cheaper than normal using current methods while reducing wastage at same time as well making production safer simply by avoiding worker exposure toxic materials associated with its conventional manufacturing procedures . Furthermore use smart enables automation within manufacturing outlay thus lowering overall costs among producers such that this can be observed even within production in petrochemical industry .

Leave a Comment