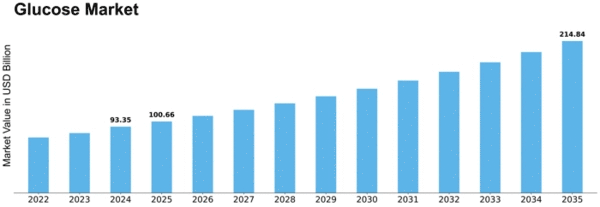

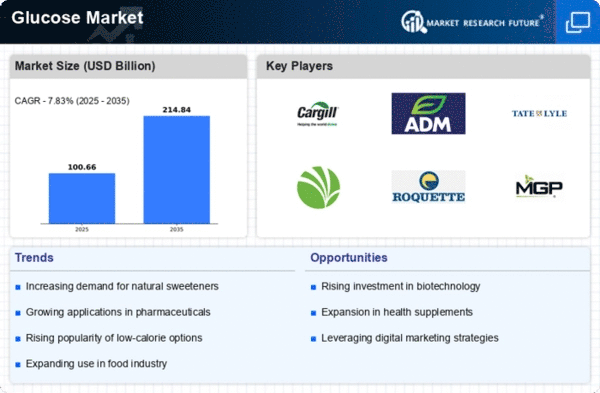

Glucose Size

Glucose Market Growth Projections and Opportunities

The Glucose market is influenced by a variety of factors that collectively shape its dynamics and growth patterns. One of the fundamental drivers of this market is the increasing prevalence of health-conscious consumers who seek alternatives to traditional sweeteners. Glucose, a natural sugar derived from carbohydrates, is perceived as a healthier option compared to refined sugars and high-fructose corn syrup. As concerns about obesity and lifestyle-related diseases grow, consumers are gravitating towards products with lower glycemic indexes, prompting the adoption of glucose as a sweetening agent in various food and beverage applications.

The global trend towards clean-label and natural ingredients is another significant factor influencing the Glucose market. Consumers are increasingly scrutinizing product labels, preferring products with recognizable and minimal ingredients. Glucose, being a natural sugar, aligns with this demand for clean-label products. Manufacturers are responding by incorporating glucose into a range of products, from energy drinks to confectionery, to meet the consumer preference for naturally derived sweeteners.

Changing dietary patterns, including the rise of low-carb and ketogenic diets, contribute to the dynamics of the Glucose market. While some consumers are reducing their overall carbohydrate intake, they still seek alternatives that provide energy without the perceived negative effects of high-fructose sugars. Glucose serves as a viable solution, providing a quick and easily digestible source of energy without causing spikes in blood sugar levels. This versatility positions glucose as a favorable ingredient in the evolving landscape of dietary preferences.

Moreover, the pharmaceutical and medical sectors significantly impact the Glucose market. Glucose is widely used in medical settings, including hospitals and clinics, for diagnostic purposes such as glucose tolerance tests. The healthcare industry's demand for high-quality glucose contributes to the overall market dynamics. Additionally, the increasing prevalence of diabetes globally has led to a growing market for glucose as a key component in various diabetic-friendly food products and dietary supplements.

The influence of technological advancements in food processing is evident in the Glucose market. Continuous innovations in extraction, purification, and formulation techniques enable manufacturers to produce high-quality glucose with improved taste and functional properties. These technological advancements contribute to the versatility of glucose, making it applicable in an array of food and beverage formulations, from sports drinks to baked goods.

Changing consumer lifestyles and the demand for convenient on-the-go products also impact the Glucose market. Glucose is a common ingredient in energy bars, gels, and sports drinks, catering to consumers seeking quick and accessible sources of energy during physical activities. The convenience factor associated with glucose-infused products aligns with the busy lifestyles of modern consumers, driving its inclusion in a variety of snack and beverage options.

The impact of economic factors on the Glucose market cannot be overlooked. Fluctuations in raw material prices, including corn and wheat, directly influence the cost of glucose production. Economic conditions and trade dynamics can affect the overall market pricing and availability of glucose, impacting both manufacturers and consumers. Therefore, market players need to navigate these economic factors and establish resilient supply chains to ensure stable market operations.

Leave a Comment