Market Analysis

In-depth Analysis of Glucose Market Industry Landscape

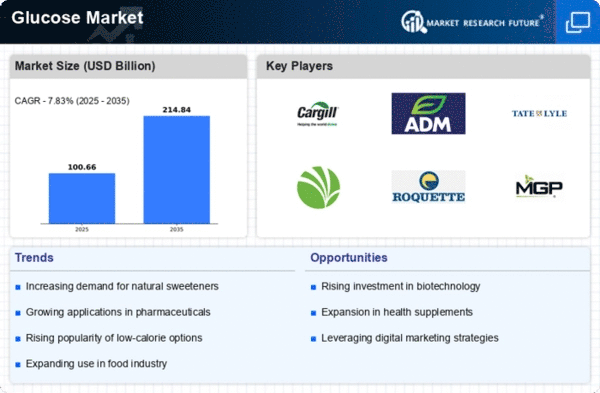

The Glucose Market is undergoing significant trends, reflecting the diverse applications and changing dynamics within the food and beverage industry. One notable trend is the increasing demand for natural sweeteners and clean-label products. As consumers become more health-conscious and scrutinize the ingredients in their food, there's a growing preference for glucose as a sweetening agent due to its natural origin. Derived primarily from corn or wheat, glucose serves as a transparent alternative to artificial sweeteners, aligning with the clean-label movement that emphasizes simplicity and recognizability of ingredients.

The global rise in health concerns and the quest for alternative sweeteners have propelled the Glucose Market into the spotlight. Glucose, being a simple sugar and a primary source of energy for the body, has found application not only in the food and beverage sector but also in the pharmaceutical industry. The demand for glucose as an energy booster in sports and nutrition products has surged, catering to fitness enthusiasts and individuals seeking quick and natural energy sources. This trend is indicative of the growing awareness of the importance of energy balance and the role of sugars in supporting an active lifestyle.

The Glucose Market is witnessing diversification in terms of product forms and applications. Beyond traditional liquid glucose or syrup, manufacturers are introducing glucose in powder and crystalline forms, expanding its versatility and applications. This diversification caters to the evolving needs of food processors, confectioners, and pharmaceutical companies, providing them with options that suit specific production processes and end-product requirements. The ease of handling and storage associated with powdered glucose contributes to its popularity in various industries.

Another significant trend in the Glucose Market is the emphasis on functional foods and nutritional products. Glucose is not merely seen as a sweetener but is increasingly utilized for its functional properties. In the context of sports nutrition and energy drinks, glucose is recognized as a quick and efficient source of carbohydrates, aiding in rapid energy replenishment during physical activity. The market is witnessing a surge in the incorporation of glucose into functional food and beverage products designed to meet specific nutritional needs and performance goals.

The global glucose market is also influenced by the growing prevalence of diabetes and the demand for sugar alternatives. As consumers become more conscious of their sugar intake due to health concerns, glucose, with its lower glycemic index compared to sucrose, is gaining traction as a suitable substitute. This trend aligns with the broader movement towards reduced sugar and healthier dietary choices, driving the adoption of glucose in various food and beverage formulations.

Sustainability is becoming a key factor shaping the Glucose Market. Manufacturers are increasingly focusing on sustainable sourcing of raw materials, energy-efficient production processes, and eco-friendly packaging. This reflects the growing importance of environmental considerations in consumer purchasing decisions. Brands that prioritize sustainability are likely to gain a competitive edge in the market as consumers seek products that align with their values and contribute to minimizing the environmental impact.

Leave a Comment