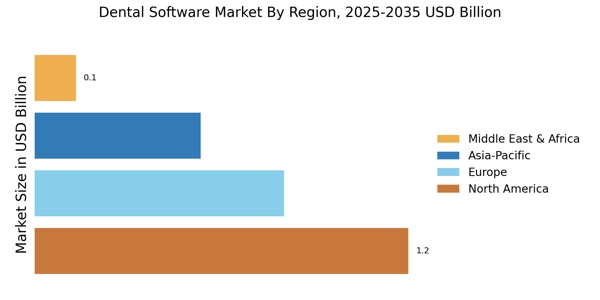

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Dental Software market accounted for USD 1.007 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period.

North American adoption of dental software has been earlier and faster than in other regions. More dental laboratories than ever before are using 3-D printers, digital design software, and CAD/CAM management system to treat various dental conditions.

One of the main drivers of the market growth in the United States is the strategic presence of major players like Henry Schein One & Curve Dental, as well as the rapid uptake of oral care services by baby boomers. The use of dental software has significantly impacted the dental workflow throughout the dental industry.

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: DENTAL SOFTWARE MARKET SHARE BY REGION 2023 (%)

The European dental software market holds the second-largest market share due to growing private player consolidation, rising quality and affordability of entry-level management software, technological developments in the dental healthcare sector, and increasing consumer preference and acceptance for innovative and advanced dental software-based services.

Moreover, stricter documentation of clinical documentation under the General Data Protection Regulation (GDPR) is pushing dental clinics, laboratories, and associated professionals to digitalize their entire information flow to be in sync with regulation compliance.

Further, the German market of dental software held the largest market share, and the UK market of dental software was the fastest-growing market in the European region.

The Asia-Pacific Dental Software Market is expected to grow at the fastest CAGR from 2022 to 2030. This market's expansion can be attributed to increased investments in healthcare IT, improved healthcare infrastructure, and the adoption of advanced technologies by dental professionals and other healthcare professionals.

The number of dental clinics is rising due to the expanding dental tourism in Asia-Pacific. Additionally, the increased use of these technologies by dental professionals in this region results from the rising prevalence of dental disorders brought on by tobacco use, poor oral hygiene, and technological advancements in oral treatment.

Moreover, China’s market of dental software held the largest market share, and the Indian market of dental software was the fastest-growing market in the Asia-Pacific region.