Growing Focus on Preventive Care

The growing focus on preventive care is reshaping the Dental Charting Software Market Industry. As healthcare systems increasingly prioritize preventive measures, dental practices are adopting software that facilitates early detection and intervention. This shift is reflected in the rising number of dental screenings and check-ups, which are supported by data showing a 20% increase in preventive care visits over the past few years. Dental charting software that incorporates features for tracking preventive care metrics is becoming essential for practices aiming to improve patient health outcomes. This trend is likely to drive the demand for specialized software solutions within the Dental Charting Software Market Industry.

Increased Investment in Dental Technology

Increased investment in dental technology is a significant driver of the Dental Charting Software Market Industry. As dental practices recognize the importance of technology in enhancing patient care, there is a marked increase in spending on advanced software solutions. Recent statistics indicate that dental technology investments have risen by 15% annually, reflecting a growing commitment to adopting innovative tools. This investment not only improves operational efficiency but also enhances the overall patient experience. Consequently, the demand for sophisticated dental charting software is expected to rise, as practices seek to leverage technology to stay competitive in the evolving dental landscape.

Regulatory Compliance and Standardization

Regulatory compliance and standardization are increasingly influencing the Dental Charting Software Market Industry. Dental practices are required to adhere to stringent regulations regarding patient data security and privacy. Consequently, software solutions that ensure compliance with these regulations are in high demand. The implementation of standards such as HIPAA in the United States necessitates that dental software providers incorporate robust security features. This compliance not only protects patient information but also enhances the credibility of dental practices. As a result, the market for compliant dental charting software is expected to expand, driven by the need for secure and standardized solutions.

Technological Advancements in Dental Software

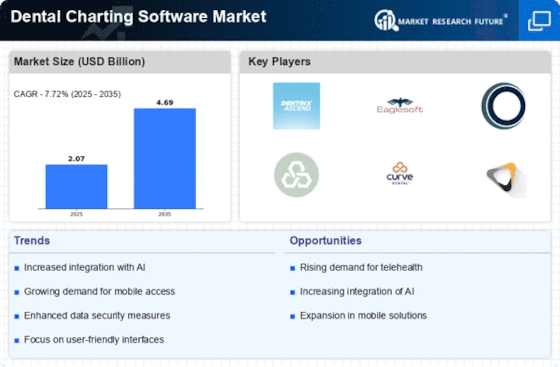

Technological advancements play a crucial role in shaping the Dental Charting Software Market Industry. Innovations such as artificial intelligence and machine learning are being integrated into dental software, enhancing diagnostic capabilities and treatment planning. These technologies enable practitioners to analyze patient data more effectively, leading to improved patient outcomes. Furthermore, the market is witnessing a shift towards mobile applications, allowing dentists to access patient information on-the-go. This trend is supported by data indicating that practices adopting mobile-friendly solutions experience a 25% increase in patient engagement. As technology continues to evolve, the Dental Charting Software Market Industry is poised for significant growth.

Rising Demand for Efficient Patient Management

The Dental Charting Software Market Industry experiences a notable surge in demand for efficient patient management solutions. As dental practices strive to enhance operational efficiency, the need for software that streamlines patient records, appointments, and treatment plans becomes paramount. This trend is underscored by the increasing patient volume in dental clinics, which necessitates robust management tools. According to recent data, practices utilizing advanced dental charting software report a 30% improvement in appointment scheduling efficiency. This growing emphasis on patient management is likely to drive the adoption of innovative software solutions, thereby propelling the Dental Charting Software Market Industry forward.