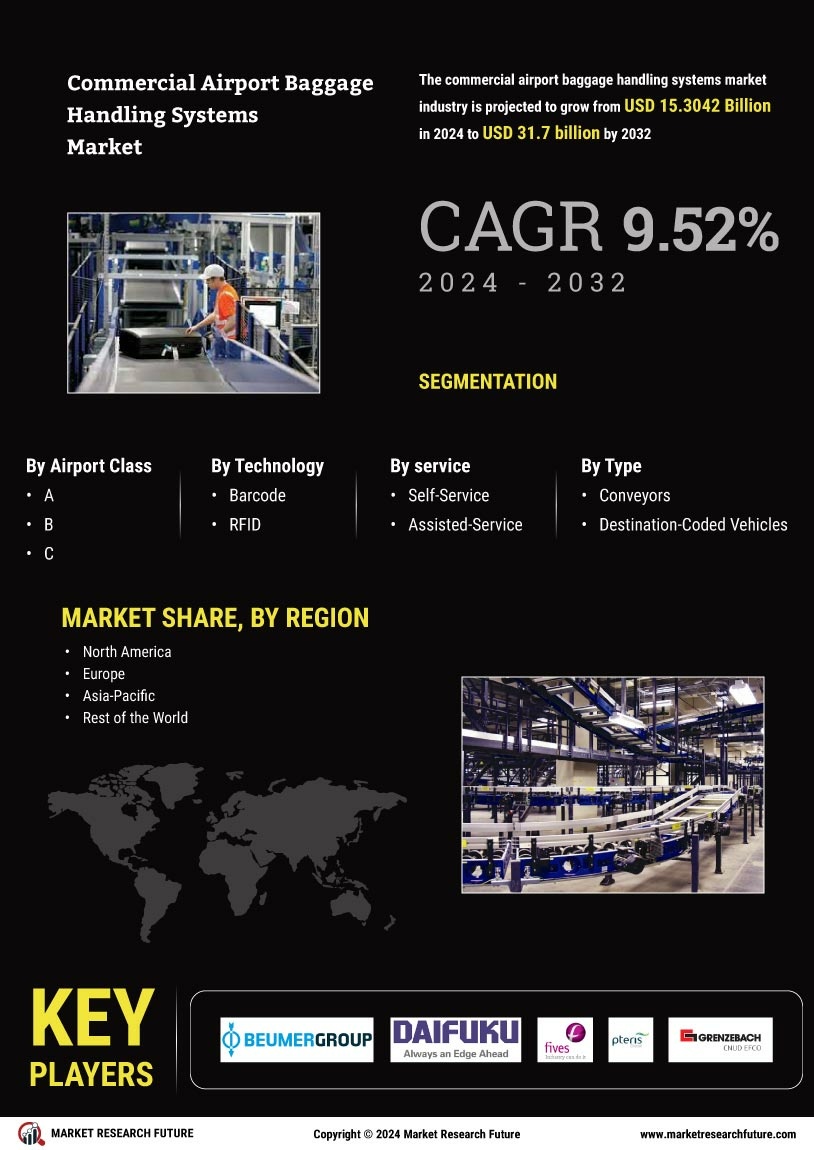

Global Commercial Airport Baggage Handling Systems Market Overview

Commercial Airport Baggage Handling Systems Market Size was valued at USD 13.8 billion in 2023. The commercial airport baggage handling systems market industry is projected to grow from USD 15.3042 Billion in 2024 to USD 31.7 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 9.52% during the forecast period (2024 - 2032). Increased focus on improving airport operational effectiveness and growing numbers of passengers flying are the key market drivers enhancing the market growth.

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Commercial Airport Baggage Handling Systems Market Trends

- Increased investment in airport infrastructure development propels market growth

Market CAGR for commercial airport baggage handling systems is being driven by increase in airport infrastructure development investments to accommodate rising passenger traffic. Market expansion is expected to be aided by rising disposable income and a growing population. Furthermore, investors are installing more sophisticated baggage handling systems to improve operational effectiveness, which is likely to encourage market revenue growth.

However, high maintenance costs and baggage mishandling at airports are impeding revenue growth. Misplaced baggage increased by 24% as airports and airlines struggled to keep up with passenger demand. Social media users have shared photos of unclaimed bags, and angry anecdotes have accumulated. One traveller used an Apple Air Tag to track her misplaced bag from Toronto to St. John Airport for five days. Someone saw his rucksack leave for England, Germany, and Iceland without him. As an increasing number of travellers return to flying, the industry is closely examining the future of luggage management.

Commercial Airport Baggage Handling Systems Market Segment Insights

- Commercial Airport Baggage Handling Systems Airport Class Insights

The commercial airport baggage handling systems market segmentation, based on airport class includes A, B and C. The C accounted for a sizable market share. Furthermore, Class C airspace regions are intended to improve aviation safety by lowering the likelihood of mid-air crashes in the terminal area and improving the management of air traffic operations inside it. Certain operating restrictions and equipment requirements apply to aircraft operating in these airspace zones.

- Commercial Airport Baggage Handling Systems Technology Insights

The commercial airport baggage handling systems market segmentation, RFID and barcode are two technology-based market segments. Due to the technology's affordability and dependability in streamlining the baggage handling process, the RFID technology segment is anticipated to experience the highest growth. RFID improves passenger experience by cutting the rate of baggage mishandling by almost 20%. The IATA resolution 753 can be easily complied with by obtaining the history of baggage handling errors. For the benefit of their customers' travel experiences, the major airline companies are investing in RFID technology.

Figure 1: Commercial Airport Baggage Handling Systems Market, by Technology, 2022 & 2032 (USD billion)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

- Commercial Airport Baggage Handling Systems Service Insights

The commercial airport baggage handling systems market segmentation, based on service, includes self-service and assisted service. Self-service accounted for a sizable market share. The use of self-service technology allows the airport to decentralize the processing of a large number of passengers, allowing for better use of staff who may be needed in other sections of the airport. To begin, passengers should deposit their luggage on the scales located at the bag-drop station.

- Commercial Airport Baggage Handling Systems Type Insights

The commercial airport baggage handling systems market segmentation, based on type, includes conveyors and destination-coded vehicles. As DCVs operate about 4.5 times faster than conveyor baggage handling systems, the destination-coded vehicles segment is anticipated to present profitable growth opportunities (BHS). It is being installed in large airports with multiple terminals even though the technology is relatively new. Factors like the rising number of air travellers and the upgrading of airport infrastructure, including technological advancement and capacity enhancement, are credited for the quick growth of this market.

- Commercial Airport Baggage Handling Systems Regional Insights

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America dominates the commercial airport baggage handling systems market and is projected to maintain its position over the forecast period. This expansion can be ascribed to early adoption of these technologies as well as increased government investment in airport infrastructure.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: COMMERCIAL AIRPORT BAGGAGE HANDLING SYSTEMS MARKET SHARE BY REGION 2022 (%)

Source Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe’s commercial airport baggage handling systems market accounts for the second-largest market share due to stricter airport security regulations and increased expenditure in terminal expansions. Further, the German commercial airport baggage handling systems market held the largest market share, and the UK commercial airport baggage handling systems market was the fastest-growing market in the European region.

The Asia-Pacific Commercial Airport Baggage Handling Systems Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the expansion of airport infrastructure to support the region's rising airline passenger numbers in recent years. Moreover, China’s commercial airport baggage handling systems market held the largest market share, and the Indian commercial airport baggage handling systems market was the fastest-growing market in the Asia-Pacific region.

Commercial Airport Baggage Handling Systems Key Market Players & Competitive Insights

Leading market players are investing heavily in R&D in order to expand their product lines, which will help the commercial airport baggage handling systems market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the commercial airport baggage handling systemsindustry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the commercial airport baggage handling systems industry to benefit clients and increase the market sector. In recent years, the commercial airport baggage handling systems industry has offered some of the most significant advantages to medicine. Major players in the commercial airport baggage handling systems market, including Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.) and others, are attempting to increase market demand by investing in R&D operations.

Kuala Lumpur International Airport is Malaysia's primary international airport. It is located in the Sepang District of Selangor, roughly 45 kilometers (28 miles) south of Kuala Lumpur and serves the city's broader conurbation. Malaysia's largest and busiest airport is KLIA. It handled 13,156,363 passengers, 505,184 tonnes of cargo, and 124,529 aircraft movements in 2020. It is the world's 23rd busiest airport by total passenger traffic. In December 2022, Kuala Lampur International Airport in Malaysia announced that Siemens Logistics and local company T7 have been contracted to update the baggage handling system (BHS) at Terminal 1. The contract calls for the systematic decommissioning of the present system as well as the design, installation, and commissioning of new baggage handling systems. Siemens will provide VarioTray and VarioBelt technology, as well as VarioStore early bag storage and high-performance controlling software. The VarioBelt conveyor will also be available in the baggage handling systems industry.

SITA is a worldwide information technology business that provides information technology and telecommunications services to the airline sector. The corporation claims to serve around 400 members and 2,500 customers ly, accounting for approximately 90% of the world's airline industry. SITA technology is used on practically every passenger aircraft across the world. In June 2022, SITA announced a collaboration agreement with Alstef Group, a well-known baggage handling company, to create Swift Drop, a revolutionary self-bag drop system that dramatically improves the experience of travellers checking their bags. The quick and simple interface allows customers to check their bags quickly, avoiding huge lines at traditional check-in locations.

Key Companies in the commercial airport baggage handling systems market include

- Beumer Group (Germany)

- Daifuku Company Ltd (Japan)

- Fives Group (France)

- Pteris Limited (Singapore)

- Grenzebach Maschinenbau GMBH (Germany)

- G&S Airport Conveyor (U.S.)

- Logplan LLC (U.S.)

- BCS Group (New Zealand)

- Siemens AG (Germany)

- Vanderlande Industries (Netherlands).

Commercial Airport Baggage Handling Systems Industry Developments

For Instance, In December 2022, Kuala Lampur International Airport in Malaysia announced that Siemens Logistics and local company T7 have been contracted to update the baggage handling system (BHS) at Terminal 1. The contract calls for the systematic decommissioning of the present system as well as the design, installation, and commissioning of new baggage handling systems. Siemens will provide VarioTray and VarioBelt technology, as well as VarioStore early bag storage and high-performance controlling software. The VarioBelt conveyor will also be available in the baggage handling systems industry.

For Instance, In August 2022 Alstef announced the launch of a new mobile robot for baggage handling at airports. The BAGXone is a novel machine with a high-speed automated guided vehicle designed to handle individual bags. It can travel short distances, such as from the check-in area to the screening machines, or from the screening machines to an early bag store, reconciliation room, and make-up carousel.

For Instance, In April 2021 Siemens Logistics, a subsidiary of Siemens AG, received a contract from Incheon International Airport Corporation to expand the baggage handling system at Terminal 2 of Incheon Airport. In addition to the installation of baggage conveying and sorting technology, the company will provide technical project management, layout design, and software solutions and integrate the new equipment into the existing system.

Commercial Airport Baggage Handling Systems Market Segmentation

Commercial Airport Baggage Handling Systems Market by Airport Class Outlook

Commercial Airport Baggage Handling Systems Market by Technology Outlook

Commercial Airport Baggage Handling Systems Market by service Outlook

- Self-Service

- Assisted-Service

Commercial Airport Baggage Handling Systems Market by Type Outlook

- Conveyors

- Destination-Coded Vehicles

Commercial Airport Baggage Handling Systems Regional Outlook

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

| Report Attribute/Metric |

Details |

| Market Size2023 |

USD 13.8 billion |

| Market Size 2024 |

USD 15.3042 billion |

| Market Size2032 |

USD 31.7 billion |

| Compound Annual Growth Rate (CAGR) |

9.53% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Airport Class, Technology, Service, Type and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Beumer Group (Germany), Daifuku Company Ltd (Japan), Fives Group (France), Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.), BCS Group (Hew Zealand), Siemens AG (Germany), and Vanderlande Industries (Netherlands). |

| Key Market Opportunities |

Al is increasingly being used to ensure airport safety |

| Key Market Dynamics |

Increases in the number of passengers flying. |

Commercial Airport Baggage Handling Systems Market Highlights:

Frequently Asked Questions (FAQ) :

The commercial airport baggage handling system’s market size was valued at USD 13.8 Billion in 2023.

The market is projected to grow at a CAGR of 9.52% during the forecast period, 2024-2032.

North America had the largest share in the market.

The key players in the market are Pteris Limited (Sir gapore), Grenzebach Maschinenbau GMBH (Germany), G&S Airport Conveyor (U.S.), Logplan LLC (U.S.).

The destination-coded vehicles (DCV) category dominated the market in 2022.

RFID had the largest share of the market.