Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the airport automation Market. Airports are increasingly pressured to reduce operational costs while enhancing service delivery. Automation technologies, such as self-service kiosks and automated baggage handling systems, offer substantial savings by minimizing labor costs and reducing the likelihood of human error. Reports suggest that airports implementing these technologies can achieve cost reductions of up to 30% in certain operational areas. This focus on cost efficiency is not only beneficial for airport operators but also enhances the overall passenger experience by reducing wait times and improving service reliability. As the Airport Automation Market evolves, the emphasis on cost-effective solutions will likely continue to shape investment decisions and operational strategies.

Rising Passenger Traffic

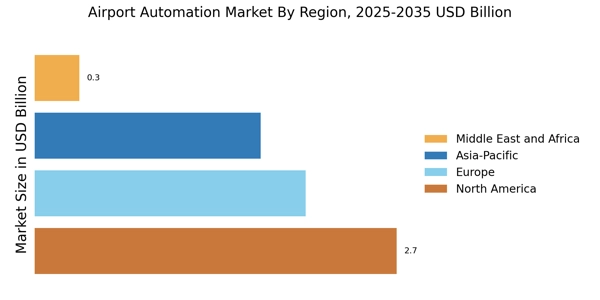

The Airport Automation Market is significantly influenced by the rising passenger traffic observed across various regions. As air travel becomes more accessible, airports are facing unprecedented challenges in managing the influx of travelers. This increase in passenger numbers necessitates the adoption of automated systems to ensure smooth operations. Data indicates that passenger traffic is expected to reach over 8 billion by 2030, which underscores the urgency for airports to invest in automation technologies. By implementing automated processes, airports can enhance their capacity to handle larger volumes of passengers without compromising service quality. Consequently, the Airport Automation Market is poised for growth as stakeholders seek solutions that can accommodate this rising demand while optimizing operational workflows.

Sustainability Initiatives

Sustainability initiatives are emerging as a crucial driver in the Airport Automation Market. Airports are increasingly recognizing the importance of reducing their environmental impact and are seeking automation solutions that contribute to sustainability goals. Automated systems can optimize energy consumption, reduce waste, and enhance resource management, aligning with global sustainability targets. For instance, automated baggage handling systems can minimize energy usage and improve efficiency, contributing to lower carbon footprints. As stakeholders prioritize sustainability, the Airport Automation Market is expected to witness a shift towards technologies that not only enhance operational efficiency but also support environmental stewardship. This focus on sustainability may drive innovation and investment in eco-friendly automation solutions.

Technological Advancements

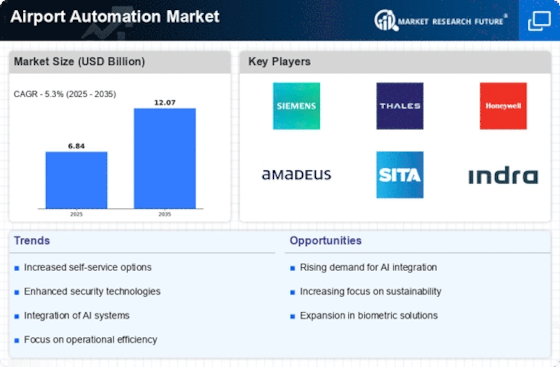

The Airport Automation Market is experiencing a surge in technological advancements, particularly in areas such as biometrics and artificial intelligence. These innovations are streamlining operations, enhancing security, and improving passenger experiences. For instance, the implementation of automated check-in kiosks and self-bag drop systems has been shown to reduce wait times significantly, thereby increasing operational efficiency. According to recent data, the market for airport automation technologies is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for airports to manage increasing passenger volumes while maintaining high service standards. As technology continues to evolve, the Airport Automation Market is likely to see further integration of smart solutions that enhance both operational efficiency and customer satisfaction.

Regulatory Compliance and Security

The Airport Automation Market is increasingly shaped by the need for regulatory compliance and enhanced security measures. Governments and aviation authorities are imposing stricter regulations to ensure passenger safety and security, which necessitates the adoption of advanced automation technologies. Automated screening systems and biometric identification solutions are becoming essential tools for airports to meet these regulatory requirements. The market for security automation is projected to grow significantly, driven by the need for efficient and reliable security processes. As airports strive to comply with these regulations while maintaining operational efficiency, the Airport Automation Market is likely to see a rise in investments in security-focused automation solutions that enhance both safety and passenger flow.