Rising Urbanization

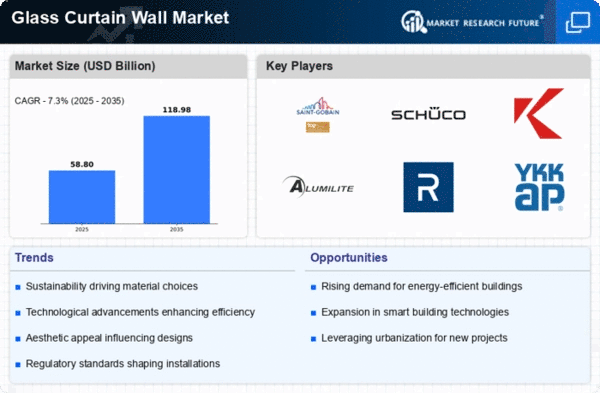

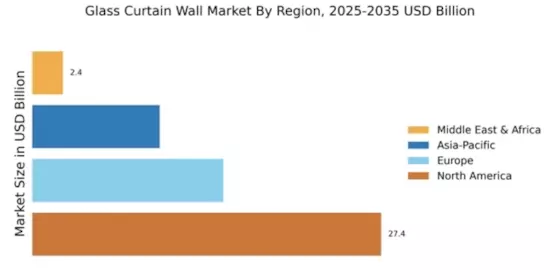

The Global Glass Curtain Wall Market Industry is experiencing substantial growth due to increasing urbanization across the globe. As more people migrate to urban areas, the demand for commercial and residential buildings rises, leading to a greater need for modern architectural solutions. Glass curtain walls are favored for their aesthetic appeal and energy efficiency, making them a popular choice among architects and builders. In 2024, the market is projected to reach 54.8 USD Billion, reflecting the growing trend of high-rise buildings and urban developments. This trend is expected to continue, with the market potentially expanding to 119.0 USD Billion by 2035.

Technological Advancements

Technological advancements in glass manufacturing and installation techniques are significantly influencing the Global Glass Curtain Wall Market Industry. Innovations such as self-cleaning glass, smart glass, and enhanced structural integrity are making glass curtain walls more appealing to builders and architects. These advancements not only improve the aesthetic value of buildings but also contribute to energy savings and sustainability. As the industry embraces these technologies, the market is poised for growth, with projections indicating a potential increase to 119.0 USD Billion by 2035. This evolution in technology is likely to redefine architectural possibilities in urban environments.

Energy Efficiency Regulations

Stringent energy efficiency regulations are driving the Global Glass Curtain Wall Market Industry as governments worldwide implement policies to reduce carbon footprints. These regulations often mandate the use of energy-efficient materials in construction, which includes glass curtain walls that offer superior thermal performance. The integration of advanced technologies, such as low-emissivity coatings and insulated glazing, enhances energy efficiency, making these systems more attractive to developers. As a result, the market is likely to witness a compound annual growth rate of 7.3% from 2025 to 2035, indicating a robust shift towards sustainable building practices.

Increased Investment in Infrastructure

Increased investment in infrastructure development is a key factor propelling the Global Glass Curtain Wall Market Industry. Governments and private entities are allocating substantial funds towards the construction of commercial and residential projects, which often incorporate glass curtain walls for their modern appeal and functionality. This influx of investment is particularly noticeable in emerging economies, where urban development is accelerating. As a result, the market is projected to reach 54.8 USD Billion in 2024, with expectations for continued growth as infrastructure projects expand globally. This trend underscores the importance of glass curtain walls in contemporary construction.

Aesthetic Appeal and Design Flexibility

The aesthetic appeal and design flexibility offered by glass curtain walls are pivotal drivers of the Global Glass Curtain Wall Market Industry. Architects increasingly prefer these systems for their ability to create visually striking facades that enhance the overall appearance of buildings. The transparency and lightness of glass allow for innovative designs that can adapt to various architectural styles. This trend is particularly evident in commercial buildings, where the desire for modern and inviting spaces is paramount. As urbanization continues to rise, the demand for aesthetically pleasing structures is expected to propel the market forward, contributing to its growth trajectory.