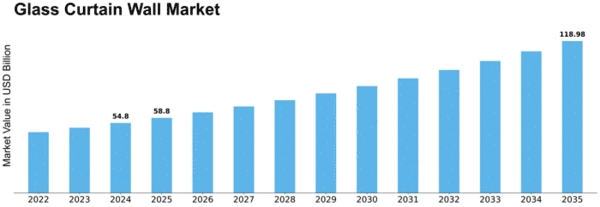

Glass Curtain Wall Size

Glass Curtain Wall Market Growth Projections and Opportunities

The Global Market for Glass Curtain Walls is impacted by a mixture of architectural, monetary, and environmental parameters, shaping the demand for these aesthetically attractive and useful building facades. Architectural traits and the pursuit of cutting-edge, smooth designs in building construction contribute significantly to the call for glass curtain partitions. Architects and designers want those obvious facades for their ability to create visually appealing and mild-stuffed systems. Continual improvements in glass production technologies enhance the talents and overall performance of glass curtain walls. Innovations such as dynamic glass with adjustable transparency, self-cleansing coatings, and expanded sturdiness contribute to the market's evolution. The requirement for weather-resistant and durable building envelopes in various climates contributes to the call for glass curtain walls. These structures are developed to withstand environmental elements, consisting of wind, rain, and temperature fluctuations, retaining structural integrity over the years. The incorporation of glass curtain partitions aligns with the desire for natural light in indoor areas. The promotion of occupant well-being, better daylighting, and a connection to the outside make contributions to the recognition of those facades in commercial, residential, and institutional homes. Economic parameters, inclusive of production budgets and standard monetary growth, have an impact on the market for glass curtain partitions. While those structures can be more expensive than traditional facades, the lengthy period of blessings, coupled with economic prosperity, pressure funding in extraordinary and visually attractive constructing envelopes. Repair and refurbishment projects impact the curtain wall glass market. With the aesthetic and energy efficiency gains in older buildings, contemporary glass curtain walls are becoming more popular than traditional facades. A catalyst that focuses on building envelope performance, including criteria such as insulation, wind, and water resistance, and determines high-performance glass curtain wall requirements. If performance requirements are met, or more is necessary to select this system in modern construction projects. Cultural and regional influences also play a role in determining architectural preferences and, consequently, the demand for glass fabric walls. Regional aesthetics, climate considerations, and cultural perceptions of transparency and modern architecture influence regional variations in the market.

Leave a Comment