Technological Advancements

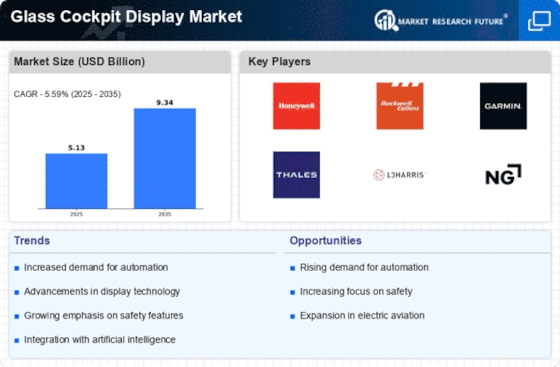

The Glass Cockpit Display Market is experiencing a surge in demand due to rapid technological advancements. Innovations in display technologies, such as OLED and LCD, enhance visual clarity and reduce weight, which is crucial for aviation applications. Furthermore, the integration of augmented reality (AR) and artificial intelligence (AI) into cockpit displays is transforming pilot interactions, making them more intuitive and efficient. According to recent data, the market for advanced cockpit displays is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next five years. This growth is driven by the need for improved situational awareness and decision-making capabilities in complex flight environments.

Shift Towards Digital Cockpits

The aviation industry is witnessing a paradigm shift towards digital cockpits, which is a key driver for the Glass Cockpit Display Market. Traditional analog displays are being replaced by digital interfaces that offer enhanced functionality and user experience. This transition is fueled by the need for more efficient data management and real-time information access. Market analysis suggests that the adoption of digital cockpit technologies is expected to increase significantly, as airlines and manufacturers recognize the benefits of streamlined operations and improved pilot training. This shift not only enhances operational efficiency but also aligns with the industry's broader goals of modernization and innovation.

Regulatory Support and Standards

Regulatory bodies play a crucial role in shaping the Glass Cockpit Display Market. The establishment of stringent safety and performance standards encourages manufacturers to innovate and improve their products. Compliance with these regulations not only enhances safety but also boosts consumer confidence in advanced cockpit technologies. Recent initiatives by aviation authorities to promote the adoption of next-generation cockpit displays are likely to stimulate market growth. As regulations evolve, manufacturers are compelled to align their products with these standards, thereby fostering a competitive environment that drives technological advancements.

Growing Commercial Aviation Sector

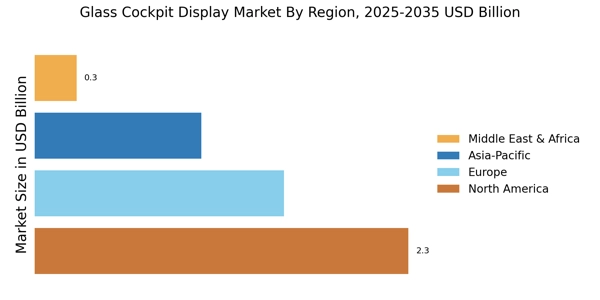

The expansion of the commercial aviation sector significantly influences the Glass Cockpit Display Market. As air travel demand continues to rise, airlines are investing in modernizing their fleets, which includes upgrading cockpit displays. The International Air Transport Association (IATA) forecasts a steady increase in passenger numbers, which in turn drives the need for more efficient and technologically advanced aircraft. This trend is likely to result in a substantial increase in the adoption of glass cockpit displays, as airlines seek to enhance operational efficiency and passenger experience through advanced avionics.

Increased Demand for Safety Features

Safety remains a paramount concern in aviation, propelling the Glass Cockpit Display Market forward. Enhanced safety features, such as real-time data monitoring and predictive analytics, are increasingly integrated into cockpit displays. These features assist pilots in making informed decisions, thereby reducing the likelihood of accidents. The market data indicates that the demand for safety-enhancing technologies is expected to rise, with a projected increase in investments in cockpit safety systems. This trend reflects a broader industry commitment to minimizing risks and ensuring the highest safety standards in aviation operations.