North America : Market Leader in Innovation

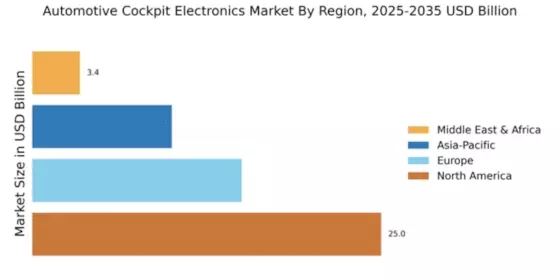

North America is poised to maintain its leadership in the Automotive Cockpit Electronics Market, holding a significant market share of 25.0% as of 2024. The region's growth is driven by increasing consumer demand for advanced infotainment systems, safety features, and connectivity solutions. Regulatory support for electric vehicles (EVs) and autonomous driving technologies further catalyzes market expansion, making it a hub for innovation and investment in automotive technologies. The competitive landscape in North America is robust, featuring key players such as Bosch, Harman, and Continental. The U.S. leads the market, supported by a strong automotive manufacturing base and a growing emphasis on smart vehicle technologies. Canada and Mexico also contribute to the market, with increasing investments in R&D and partnerships among automotive suppliers. This dynamic environment fosters collaboration and accelerates the development of cutting-edge cockpit electronics solutions.

Europe : Emerging Hub for Technology

Europe is emerging as a pivotal market for Automotive Cockpit Electronics, with a market size of €15.0 billion. The region's growth is fueled by stringent regulations aimed at enhancing vehicle safety and reducing emissions. The European Union's Green Deal and initiatives promoting electric mobility are significant catalysts for the adoption of advanced cockpit technologies, driving demand for integrated infotainment and connectivity solutions. Leading countries such as Germany, France, and the UK dominate the market, with major players like Denso and Valeo investing heavily in R&D. The competitive landscape is characterized by a focus on sustainability and innovation, with companies striving to meet regulatory standards while enhancing user experience. The presence of automotive giants and a strong supply chain further solidify Europe's position in the global market.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the Automotive Cockpit Electronics Market, with a market size of $10.0 billion. The region's expansion is driven by increasing vehicle production, rising disposable incomes, and a growing preference for advanced infotainment systems. Countries like China and Japan are at the forefront, supported by government initiatives promoting smart transportation and electric vehicles, which are key drivers of market demand. China, as the largest automotive market, plays a crucial role in shaping the competitive landscape, with local and international players vying for market share. Companies such as Panasonic and Denso are investing in innovative technologies to cater to the evolving consumer preferences. The region's focus on connectivity and automation is expected to further enhance the growth of cockpit electronics, making it a vital area for future investments.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the Automotive Cockpit Electronics Market, with a market size of $3.41 billion. Growth is primarily driven by increasing urbanization, infrastructure development, and rising vehicle ownership. Governments in the region are investing in smart city initiatives, which are expected to enhance the demand for advanced cockpit technologies, including infotainment and navigation systems. Countries like South Africa and the UAE are leading the market, with a growing number of automotive manufacturers establishing operations in the region. The competitive landscape is evolving, with both local and international players seeking to capitalize on the emerging opportunities. As the region continues to develop its automotive sector, the demand for innovative cockpit electronics is anticipated to rise significantly, presenting a promising outlook for future growth.