Ghost Kitchen Market Summary

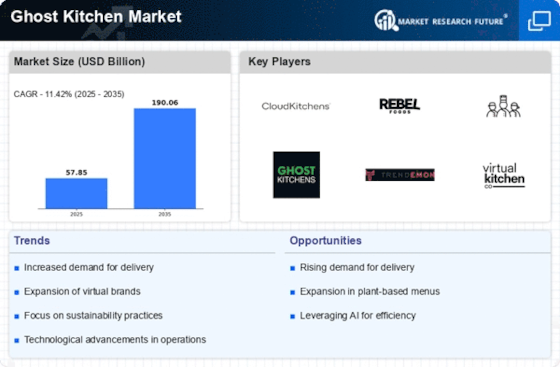

As per Market Research Future analysis, the Ghost Kitchen Market Size was estimated at 57.85 USD Billion in 2024. The Ghost Kitchen industry is projected to grow from 64.46 USD Billion in 2025 to 190.06 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 11.42% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Ghost Kitchen Market is experiencing robust growth driven by technological advancements and evolving consumer preferences.

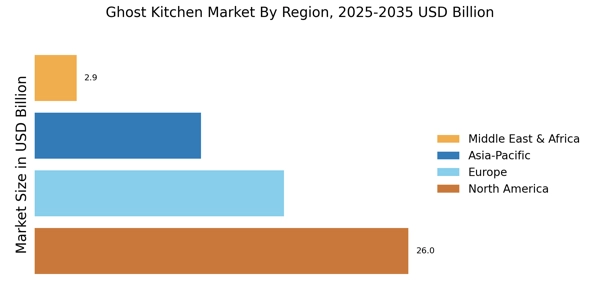

- Technological integration is reshaping operational efficiencies within the Ghost Kitchen Market, particularly in North America.

- Sustainability practices are becoming increasingly vital as consumers demand eco-friendly food options, especially in the Asia-Pacific region.

- The expansion of delivery services is facilitating market penetration, with Commissary/Shared Kitchens leading in market share.

- Rising demand for convenience and cost efficiency are key drivers propelling the growth of Kitchen Pods and Pizza and Pasta segments.

Market Size & Forecast

| 2024 Market Size | 57.85 (USD Billion) |

| 2035 Market Size | 190.06 (USD Billion) |

| CAGR (2025 - 2035) | 11.42% |

Major Players

CloudKitchens (US), Rebel Foods (IN), Kitchen United (US), Ghost Kitchen Brands (CA), TrenDemon (US), Virtual Kitchen Co. (US), Keatz (DE), Zomato (IN), Deliveroo Editions (GB)