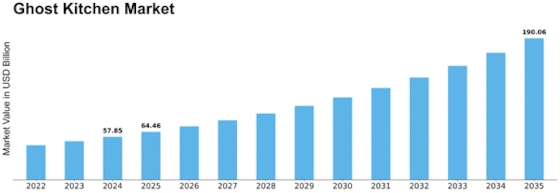

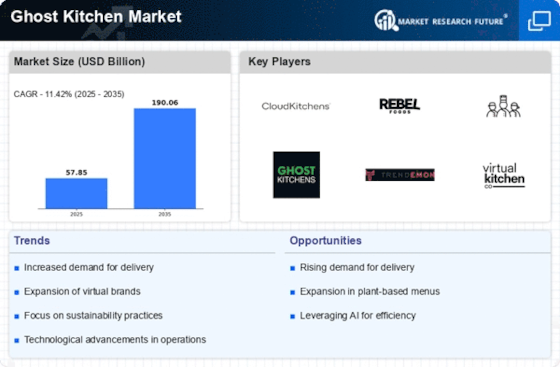

Ghost Kitchen Size

Ghost Kitchen Market Growth Projections and Opportunities

The dynamics of the ghost kitchen market are influenced by various factors that shape its growth, trends, and competitiveness. One significant factor driving the dynamics of the ghost kitchen market is the changing consumer preferences and the increasing demand for food delivery and off-premise dining options. As consumers seek convenience, variety, and affordability in their dining experiences, there is a growing need for ghost kitchens that offer virtual restaurant concepts and delivery-only meal options. These ghost kitchens operate without traditional dine-in facilities, focusing solely on food preparation and delivery, which enables them to optimize efficiency, reduce overhead costs, and cater to the growing demand for food delivery services.

Moreover, market dynamics within the ghost kitchen industry are influenced by changing restaurant industry trends and economic factors. The restaurant landscape is evolving rapidly, with traditional brick-and-mortar restaurants facing challenges such as rising rents, labor costs, and competition from delivery aggregators and third-party delivery services. Ghost kitchens offer a cost-effective alternative for restaurant operators and food entrepreneurs to launch new restaurant concepts, expand their reach, and test new menu offerings without the high upfront costs and operational complexities associated with opening a traditional restaurant. This flexibility and scalability drive the proliferation of ghost kitchen operations across various markets and geographies.

Furthermore, advancements in technology and digitalization drive market dynamics within the ghost kitchen industry. Ghost kitchen operators leverage technology platforms, online ordering systems, and delivery logistics solutions to streamline operations, optimize workflow, and enhance customer experience. Digital ordering and payment systems enable customers to place orders seamlessly from virtual restaurant menus, while delivery management platforms and route optimization algorithms optimize delivery routes and minimize delivery times. Additionally, data analytics and customer relationship management tools help ghost kitchen operators track customer preferences, gather feedback, and personalize marketing strategies to drive customer engagement and loyalty.

Supply chain dynamics and operational efficiencies also impact market dynamics within the ghost kitchen industry. Ghost kitchen operators must manage complex supply chains that encompass sourcing ingredients, managing inventory, and coordinating food preparation across multiple virtual restaurant concepts. Disruptions such as supply shortages, ingredient price fluctuations, and delivery delays can impact food quality, menu availability, and customer satisfaction, influencing market dynamics and competitive positioning. Moreover, operational efficiencies such as kitchen layout optimization, standardized recipes, and labor management strategies help ghost kitchen operators improve productivity, reduce costs, and maintain consistency in food quality and service standards.

Additionally, marketing and branding play a crucial role in shaping market dynamics within the ghost kitchen industry. Ghost kitchen operators invest in marketing strategies that emphasize brand differentiation, menu innovation, and customer engagement to stand out in a crowded marketplace. Branding elements such as logo design, packaging aesthetics, and social media presence help ghost kitchen operators create brand identity and communicate value propositions to consumers. Moreover, promotional tactics such as loyalty programs, limited-time offers, and influencer partnerships are used to drive brand awareness, stimulate trial, and encourage repeat orders among target customers.

Regulatory standards and compliance requirements also impact market dynamics in the ghost kitchen industry. Ghost kitchen operators must comply with regulations related to food safety, sanitation, and licensing to ensure the legality, safety, and integrity of their operations. Additionally, ghost kitchen operators must adhere to local zoning regulations and business licensing requirements to operate legally within their respective markets. Compliance with regulatory standards and industry best practices is essential for ghost kitchen operators to maintain consumer trust and confidence in their operations while minimizing the risk of legal and reputational issues.

Leave a Comment